Andrew Sivertsen, CFP®, EA, CeFT®, Sr Financial Planner

Concerns about money haven’t always been so severe. During the Middle Ages most people lived in a feudal system where people pledged labor and service to the select few for tracts of land to live off. This all radically changed in the industrial revolution when business giants Andrew Carnegie, John D. Rockefeller, and Henry Ford started paying their workers in weekly paychecks. The emergence of credit emerged in the 1920s to buy automobiles, the 1940s to buy houses, and the 1950s brought along the first credit card. This led to the need to buy insurance for our possessions and added to the complexity of taxes. Many households became dual income just to keep up with increasing demands forcing the need to pay for childcare and set aside money to pay for college education. All the while dreaming about exotic vacations and whether they will ever be financially independent. Today we’ve become more dependent than ever on each other from merchants across the globe to specialists in our communities.

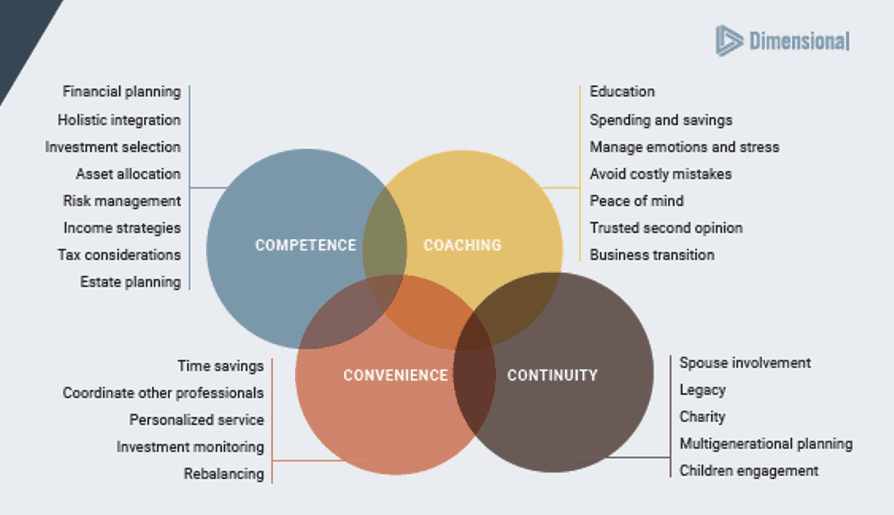

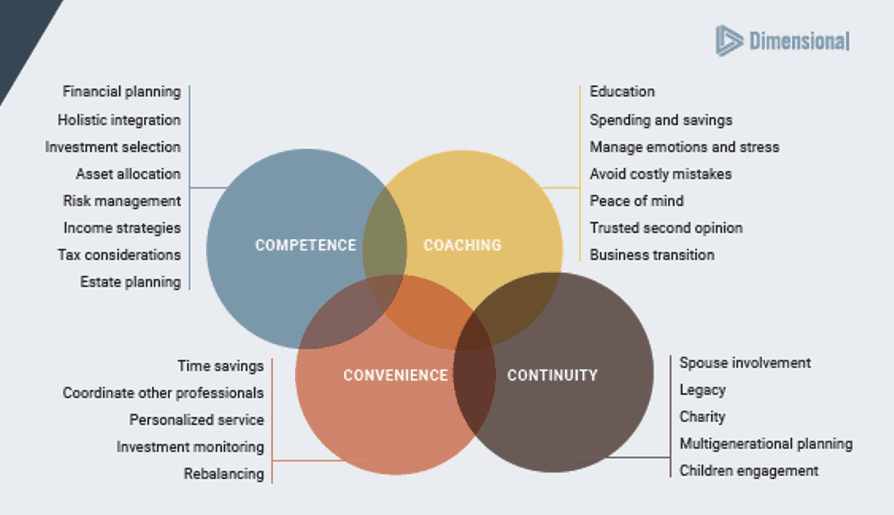

Most people know they need and want a financial life planner to organize and simplify all this complexity but aren’t sure what that all entails. This can best be broken down into the 4 Cs: Competence, Coaching, Convenience, and Continuity.

Competence

It’s best to find a planner that is a Certified Financial Planner (CFP®). This helps make sure that they are a fiduciary that will put your interests first. It also makes sure that they have upper-level education and on-going professional requirements to be knowledgeable in things like financial planning and holistic integration to pull all the pieces together. This person and often their extended team, can help make prudent decisions around investment selection, asset allocation, and risk management. All the while keeping in mind income strategies, tax considerations, and estate planning. These are all the quantitative parts of our financial lives that have become overly complex.

Coaching

Some of the best financial life planners are going to help you make sure that financial decisions line up with living your best life. If you are an affluent American, then you can have just about anything you want, but you can’t have everything. You must identify what you value most in life and make sure your time and money are reflected in those decisions. A good coach will help you with education around financial topics, make sure spending and savings align with your values, and manage emotions and stress. A planner can help you avoid costly mistakes, achieve peace of mind, and be that trusted second opinion. For some individuals they may even have the additional complexity of navigating business transitions.

Convenience

Can someone do all those things themselves? Sure, but staying up on all those things takes a lot of time and energy. Also, our emotions can get in the way and lead us to make decisions that are opposite of what we should be doing. Working with a financial life planner in an established firm should be able to help you with time savings, coordinate with other professionals, provide personalized services, and monitor and rebalance your investments as needed.

Continuity

Lastly, a financial life planner can help with the things that are extremely important that may often be forgotten. Make sure that your partner is involved in the planning process so that both of your goals are reflected in your decisions. Help with planning for legacy and/or charitable intents that will have lasting a impact. Engage your children to help make sure they are fiscally minded and that your financial life plan is built with future generations in mind.

The Planning Center was built with a 50-year vision where some day, different planners would be talking with different clients about the same pool of money. Our goal is to create a safe place for individuals and families to talk about money. When you take a step back to look at the history of finance, it’s easy to see why everyone needs to work with a financial life planner! If you know someone or are interested in working with a financial life planner, setup time to speak with one of our planners by clicking here.