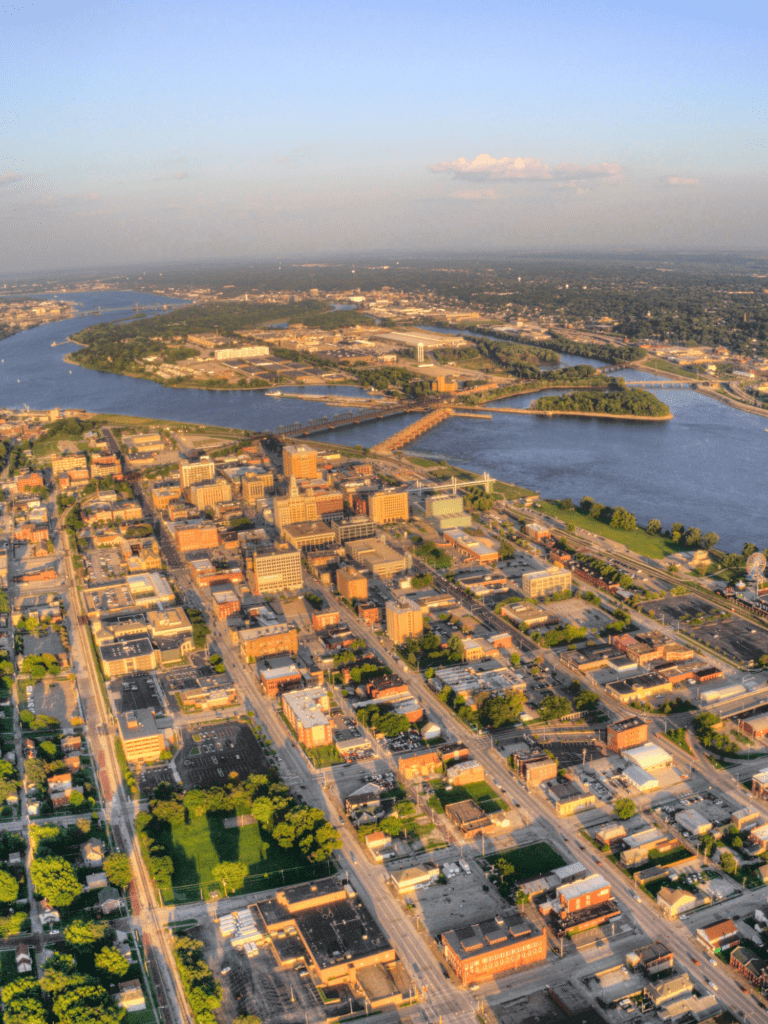

The Planning Center Quad Cities

At The Planning Center Quad Cities, our fee-only advisors provide objective financial guidance to business owners, executives/professionals, and those planning for the next stage of life. Through collaboration and continuous learning, we take a forward-looking approach to align your wealth with your life’s vision.

Connect With Our Quad Cities Office

Reach out to our Quad Cities team to discuss your goals for growing wealth, living your best life, or thriving in retirement. Through powerful relationships, we simplify financial decision-making.

Meet Our Quad Cities Team

Get to know the experienced professionals dedicated to your lifelong financial well-being. Our Quad Cities team holds themselves accountable to the highest standards of responsibility.

Where You’ve Seen Our Experts

What We Do

The Planning Center is a fee-only financial planning firm that provides a safe place for you to discuss what matters most to you and your family with a team of trusted financial advisors. In those discussions we’ll talk about a wide range of topics over our working relationships, covering these 8 major areas.

Let's Start a Conversation

Take the first step towards simplifying your financial decision-making. Complete the form below and our Quad Cities office will connect with you.

Send Us a Message

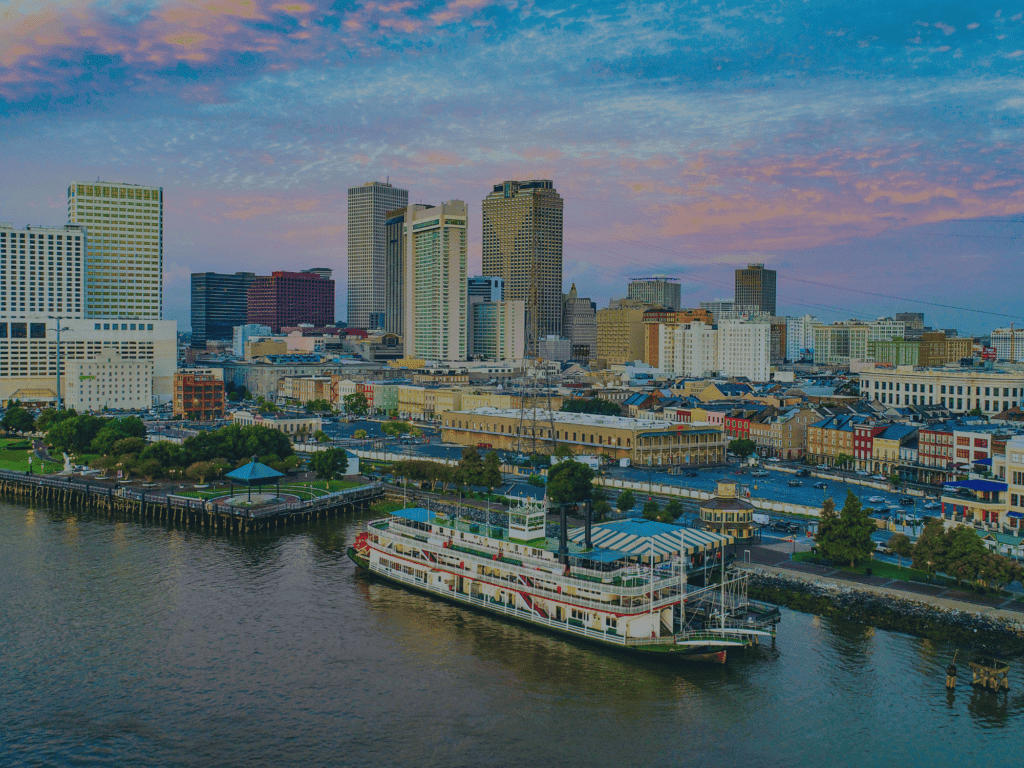

Explore Our Nationwide Network of Locations

The Planning Center has locations nationwide, working together to serve clients across the country.

Play Video

We’d like to meet you!

Schedule a free 15 minute conversation and we’ll spend a few minutes getting to know each other so we can learn if what you are seeking and what we provide are a good fit for each other. If it seems like a fit, we’ll talk about next steps. If we’re not, we’ll help you find the right group for your needs.