TPC Client Update Re: Swapping Mutual Funds to ETFs

by Andrew Sivertsen, CFP®, EA, CeFT® and Andy Baxley, CFP®, CIMA® The Planning Center’s Investment Committee meets regularly to review our investment approach and assess any potential opportunities for improving our clients’ investment experience. One such opportunity, which has been an area of focus this year, has to do with the rising popularity of exchange traded […]

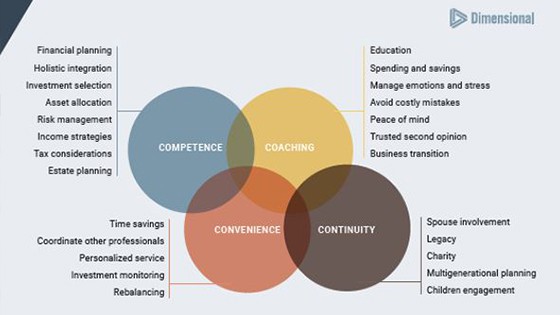

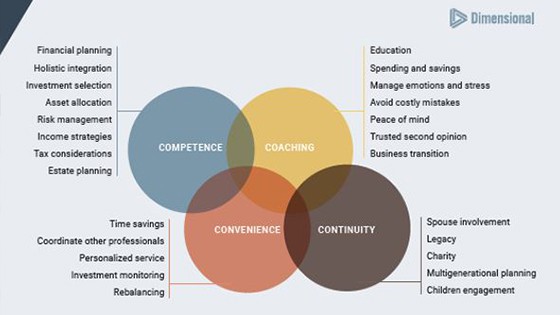

Why Do I Need a Financial Life Planner?

Andrew Sivertsen, CFP®, EA, CeFT®, Sr Financial Planner Concerns about money haven’t always been so severe. During the Middle Ages most people lived in a feudal system where people pledged labor and service to the select few for tracts of land to live off. This all radically changed in the industrial revolution when business giants […]

Understanding TPC’s Fiduciary Investment Strategies

by Andrew Sivertsen, CFP® CeFT® At The Planning Center (TPC) our investment strategy primarily uses mutual funds and ETFs to build a portfolio for our clients. Both mutual funds and ETFs are basically a wrapper for investing in a lot of underlying investments like stocks, bonds, and other financial instruments all at the same time. […]

The History of ETFs and their Rise of Popularity

by Andrew Sivertsen, CFP® CeFT® Exchange Traded Funds (ETFs) were developed in the late 90s but have grown in popularity over the last decade since the great recession. An ETF, just like a mutual fund, is a wrapper for investing that bundles a number of stocks and bonds together into one diversified investment. The primary […]

To Spend or Not to Spend

by Andrew Sivertsen, CFP® CeFT® To spend or not to spend, that is the question? “Dad! Dad! Dad! Can I buy this?” Like many parents, this is a question I hear quite often having a 9, 6, and 4-year-old in the house. The other day my oldest had found a new Harry Potter Lego set […]

The Grass Is Still Growing

by Andrew Sivertsen, CFP® CeFT® Six months ago, I wrote an article about how to manage volatility risk (the swings up and down in the markets) with an investment portfolio. You can read the full article here. Some flying analogies helped describe how to build an appropriate portfolio for your unique situation and how to […]

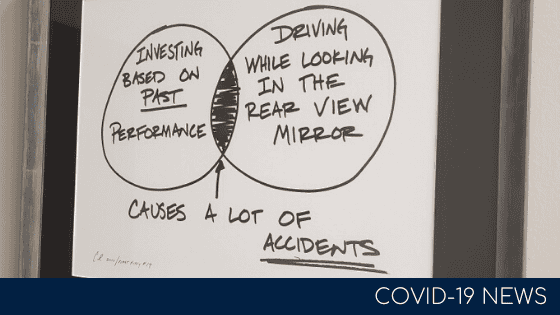

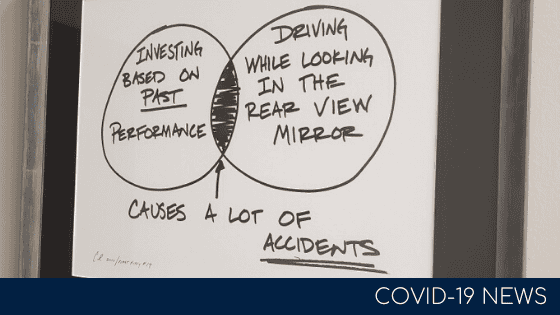

Hindsight is 2020

by Andrew Sivertsen, CFP®, CeFT® To say these are unique times would be an understatement. Like most of you, I’m currently writing this article and watching a late spring snow melt from my makeshift office and following the current stay at home orders instituted by my state. I haven’t driven anywhere but the grocery store […]

Nailing a Smooth Landing for Your Investments

by Andrew Sivertsen, CFP® There are several key principles to having a sound investment philosophy, and one of the most important is being able to deal with volatility risk. Volatility risk is accepting that fact that your investment portfolio can undergo large and unexpected swings both up and down. I think of volatility like flying […]

4 Ways to Prepare Yourself for a Market Downturn

by Andrew Sivertsen, CFP® It has been roughly eleven years since stock markets bottomed out in March of 2009. As the economic expansion continues, each new major headline naturally leaves investors wondering if this will be the event that triggers the next major market downturn; will it be a viral outbreak, trade wars, […]

5 Ways to Benefit from the SECURE Act

by Andrew Sivertsen, CFP® In December of 2019, President Trump signed into law the SECURE Act, which stands for “Setting Every Community Up For Retirement Enhancement.” While not as sweeping as the Tax Cuts and Jobs Act passed in December of 2017, there are some key changes to be aware of. Here’s what you need […]

5 Proposals to Fix Social Security

by Andrew Sivertsen, CFP® I hear a number of questions and concerns around the Social Security Program from my clients. Some wonder whether the program will be intact by the time they get to retirement. Many want to know how to optimize their benefits, and others how to better understand complex rules around spousal benefits […]

Andrew Sivertsen,CFP®, CeFT®. Partner/Sr. Financial Planner, quoted in FinancialPlanner.com on “Longer lifespans are going to affect planning for young clients, too.”

Andrew Sivertsen, CFP®, CeFT®. Partner/Sr. Financial Planner, discusses the phrase, “I’m not going to live that long,” and how that attitude needs to be taken seriously by financial planners. Read the whole article here: https://www.financial-planning.com/news/longer-lifespans-are-going-to-affect-planning-for-young-clients-too