A 2022 study by insurer Northwestern Mutual reveals some interesting interrelationships between attitudes and habits toward finance and general wellness. Conducted by the Harris polling organization, the survey asked 2,500 respondents age 18 or older a series of questions regarding their feelings about finances and also about key indicators of emotional wellness. What researchers found was that those who viewed themselves as financially disciplined or who worked with a professional financial planner reported significantly better levels of happiness and confidence. They also indicated enjoying better sleep.

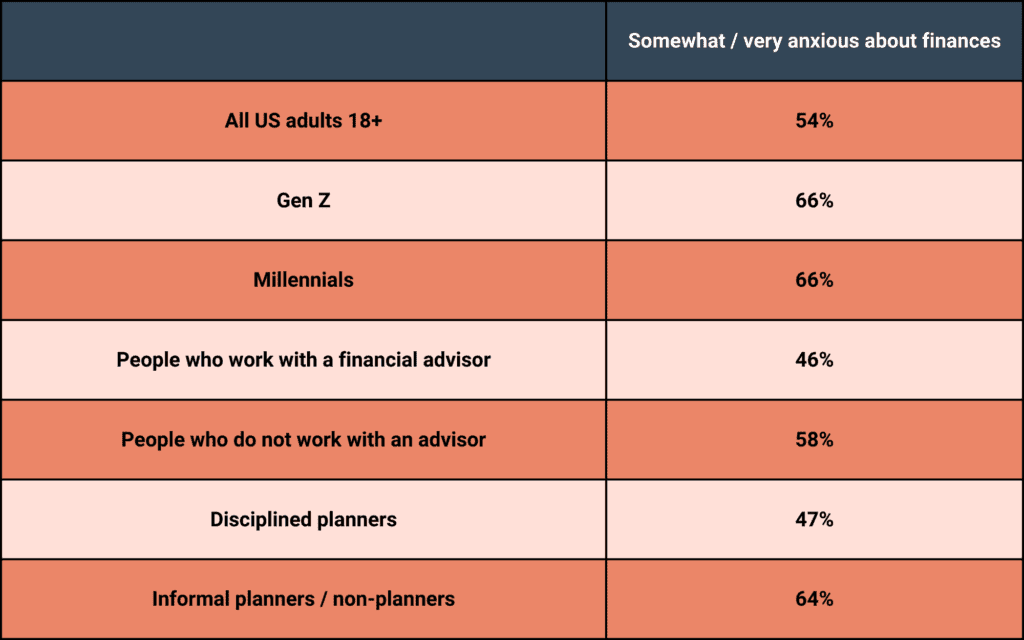

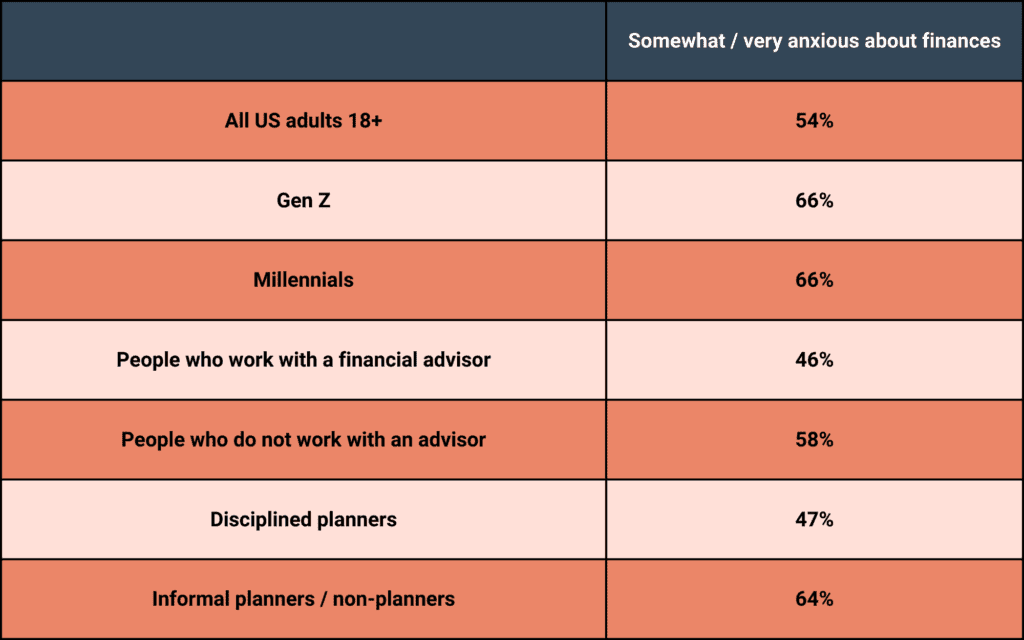

According to the survey over half (54%) of US adults are worried (either “somewhat anxious” or “very anxious”) about their finances. Interestingly, the percentage goes up considerably for GenZ and Millennials, 66% of whom are anxious about finances.

However, the percentage of those reporting such anxiety drops significantly among those who regard themselves as disciplined planners themselves and also those who are working with a financial planner.

SOURCE: Northwestern Mutual Life

Those who identify as “disciplined planners” report financial anxiety at significantly lower levels than the general population (47%), and those who say they work with a financial advisor report the lowest levels of stress and worry (46%).

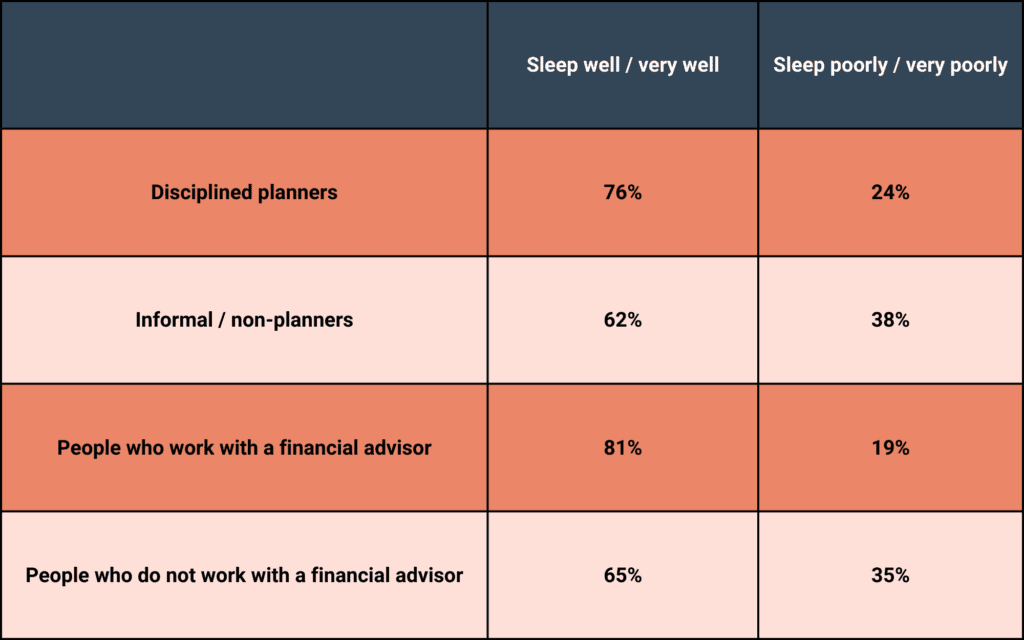

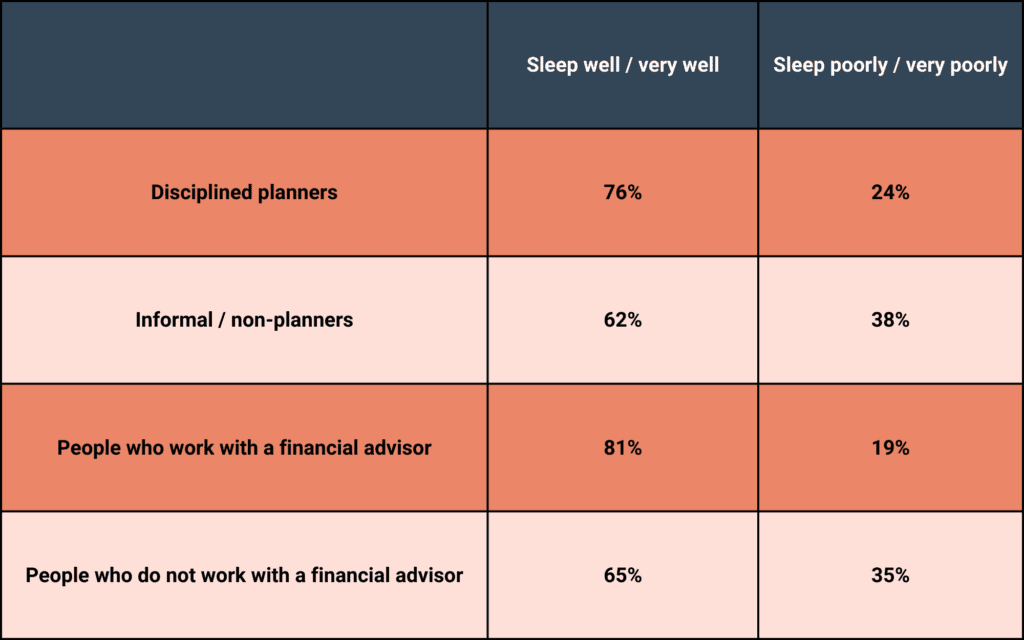

Perhaps not surprisingly, similar results emerged when respondents were asked about the quality of their sleep.

SOURCE: Northwestern Mutual Life

Clearly, there is a strong link between overall feelings of wellness and confidence and having a solid financial plan and direction. And it makes sense. The most recent figures from the Pew Research Center indicate that two of the top three things Americans are most concerned about are related to money: the economy and healthcare costs. But when you have a plan for your money that keeps you on track for reaching your most important financial goals, you worry less, you feel more optimistic about the future, and you sleep better at night.

So, what can you do if you find yourself struggling with feelings of anxiety about finances? Here are four common-sense steps to consider, based on the survey results.

1. Create a financial plan. This one seems like a no-brainer. What is more confusing and stress-inducing than being directionless, especially where finances are concerned? A financial plan allows you to look at the entirety of your financial situation—your debt, your income, your savings and investments—and compares them to your goals. Then, the plan gives you a path to get from where you are now to where you want to be. Having a direction and seeing yourself making progress may be the greatest stress reliever in the world.

2. Pay down debt. It’s simple: the more debt you have, the fewer choices you have. And with interest rates rising as the Fed tries to clamp down on inflation, you have more incentive than ever to get your debt under control and keep it there. In fact, a good financial plan will provide you with a blueprint for eliminating debt—and the stress that goes with it.

3. Create an emergency fund. Let’s face it: life happens. Financial advisors know this, which is why they recommend that you have 3–6 months’ worth of income in liquid accounts so you can handle the inevitable, unexpected situations without dipping into investments or, worse, pulling out a credit card.

4. Invest with discipline. Even if you have to start small, get in the habit of putting away money in assets that can grow, compound, and build wealth for the future. One of the best places to start is with an employer-sponsored plan at work, like a 401(k) or 403(b). In fact, many employers offer a matching contribution, allowing you even greater leverage in addition to the advantage of tax-deferred growth.

The Planning Center is a fiduciary financial advisor, which means that we provide guidance and advice that always places the client’s best interest foremost. To learn more about how we can help you plan better and worry less, visit our website to read our article, “Why You Should Work with a Fee-Only Fiduciary.”