By The Planning Center, Financial Planner

Is there anything better than getting a bonus?

Think about it: you’ve worked hard all year and you’re ready to be rewarded. Your boss sits you down, ready to tell you the good news, and they are overjoyed to be giving you an end-of-term… RSU?!

So, what exactly is an RSU?

How do these darn things work?

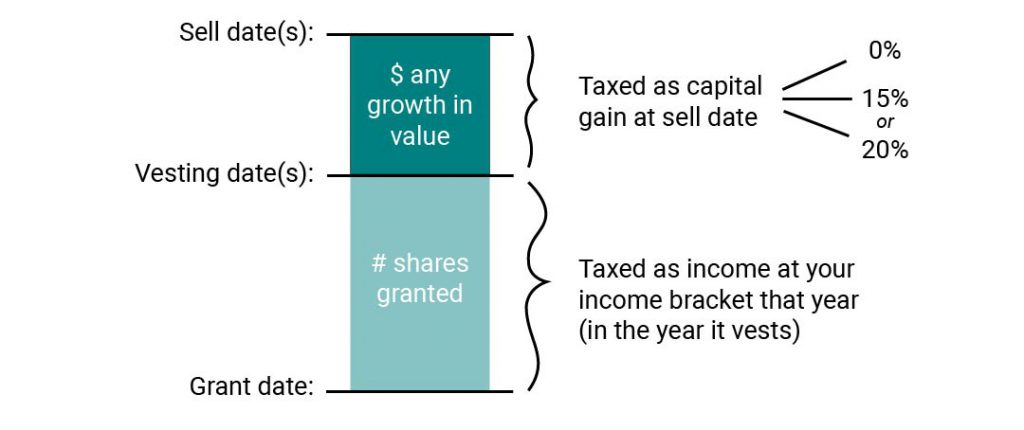

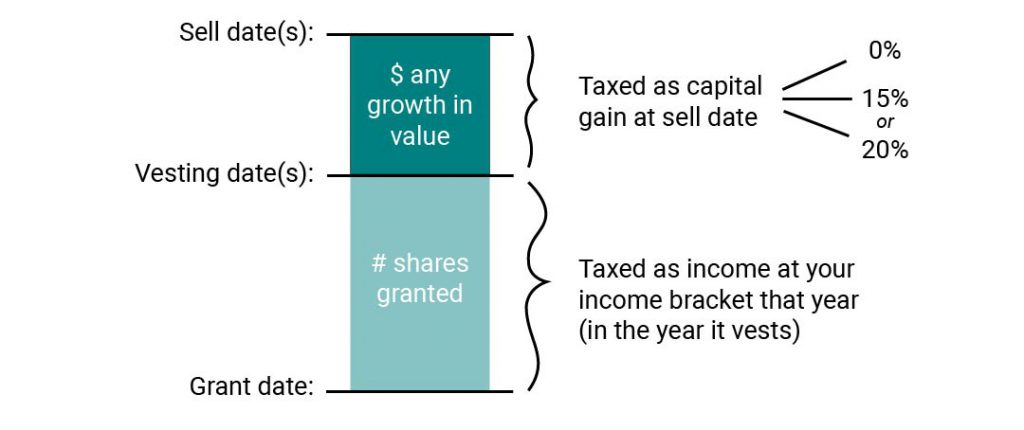

- Grant Date: Your company will “grant” you shares as of a certain date. Nothing happens on the grant date, or for a while after: you don’t have higher income, you can’t sell the shares, nothing. Basically, it’s a promise to give you shares in the future. (But, this grant date is very important down the road…)

- Vesting Date: Your company will also tell you what the “vesting” period is for these shares. Typical vesting periods are 6 months, 12 months or sometimes longer like 2 years. This period will be defined when you get the grant, and is often called the “vesting schedule,” as sometimes the full amount will not vest at the same time. For example, sometimes half of the stock granted will vest at 12 months, and the other half after 24 months.

- Once your RSU stock has vested, it is yours. You own the stock. You can decide to keep it or sell it at any point now.

- Unfortunately, this is also the date these stock units are taxable…as income. This is why it is similar to a bonus (you just had to wait to get it). Whatever the value of the stock is on that vesting date is taxable to you at your income bracket for that year. Sometimes you will sell a portion of your granted shares to pay for this tax owed. This is certainly a good strategy to consider, because, let’s be honest, who wants to PAY for their bonus?!

- All days after that Vesting Date: It’s all yours, baby! You own the stock and can keep it or sell it. Whenever you sell it, any increase in the value of that stock, its’ stock price, the difference is also taxable. So, if you sell the day after your vesting date, there is likely little growth in value, so the taxable portion will be quite small, and possibly nothing. If you wait and sell that stock days or years down the road, then it’s likely the gain will be much higher, and thus create more tax owed.

- The good news is that any of this gain is… well, gain! You’ve made money, so give yourself a pat on the back for being a wise investor.

- The other good news is that all of the gain is taxable at Capital Gains rates, which is much lower than Income tax rates/brackets. In fact, typically gains are only 15% or 20%, and sometimes 0%.

So, what should the game-plan be once you receive an RSU?

- First of all, there’s nothing you can do until the vesting date. So, at first, just hold it. Patience is key… not like you have any other choice 😉

- At the vesting date, pay the tax owed on that “bonus” (as you would if it was a cash bonus).

- After the vesting date, consider if you want to own stock of that company or not. Is it growing? Do you want to have a stake in the company? Or would you rather diversify your investment and invest in other strategies? Or do you need to build up your emergency savings account? RSU’s offer lots of different opportunities that are dependent on your specific situation and financial goals. The possibilities are endless!

Now, if your company ever offers you an RSU instead of a traditional bonus, I hope I’ve helped clear up what exactly that entails. Although not as straightforward as a bonus, an RSU definitely has its benefits!

For anyone who doesn’t have much experience investing, an RSU might seem intimidating at first. But with the right mindset and a little guidance, it really isn’t that complicated! At the end of the day, you can always sell right after the vesting date. It can also be a great introduction to investing. Who knows, maybe it’ll be the push you needed to become the next Warren Buffett!

The advisors at The Planning Center can help you set a course for personal growth, financial strength, and most importantly, peace of mind. Give us a call at 888-333-6986. Email us at info@theplanningcenter.com