By Matt Knoll, CFP ®, Sr. Financial Planner

When looking under the hood of your investment portfolio, you will notice three practices working together to add value to your portfolio.

- Aligning your allocation to your risk tolerance and goals

- Rebalancing

- Market Pricing Adjustment

Aligning Your Allocation to Your Risk Tolerance and Goals

One of the first steps in building a portfolio that’s best for you is evaluating your risk profile. Just because you’re a daredevil that jumps motorcycles over buses, doesn’t mean that you would feel comfortable with a high-risk/return portfolio. Every individual has their own risk profile. We use psychometric questionnaires to help have the conversation on what is a comfortable amount of risk for each individual.

The second step in aligning an allocation is assessing your goals and needs. Answering the questions of “how much risk is needed?” and “how much risk might jeopardize a plan?” is a critical conversation when selecting an allocation. Through Monte Carlo simulation software, we can help you see various outcomes of a particular allocation with historical market returns, best-case, and worse -case, scenarios.

Going through these steps help make a decision on a baseline portfolio split of stocks and bonds.

Rebalancing

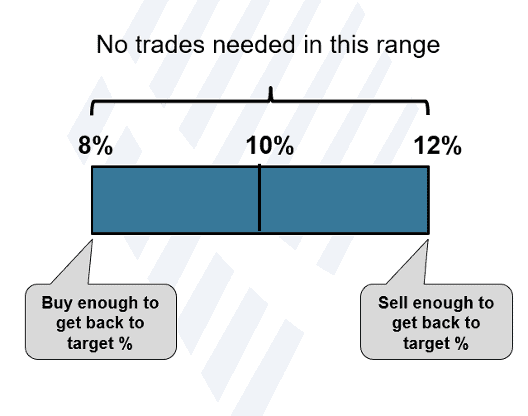

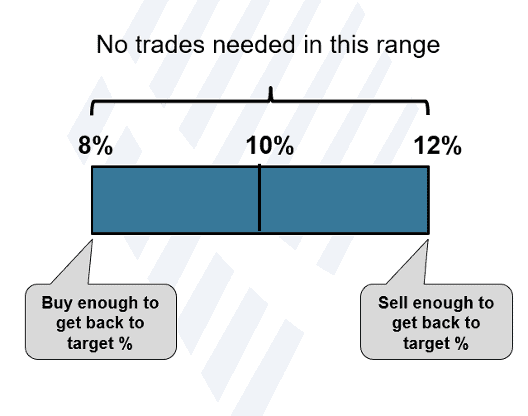

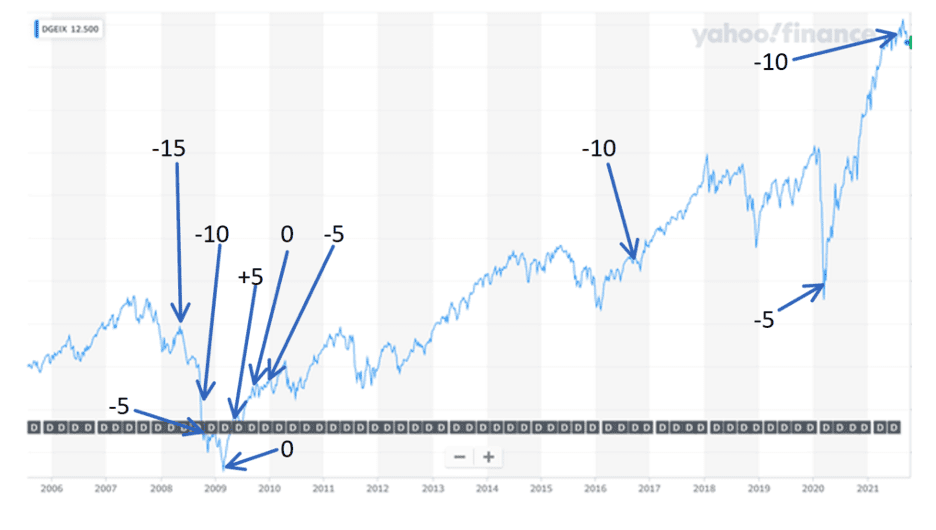

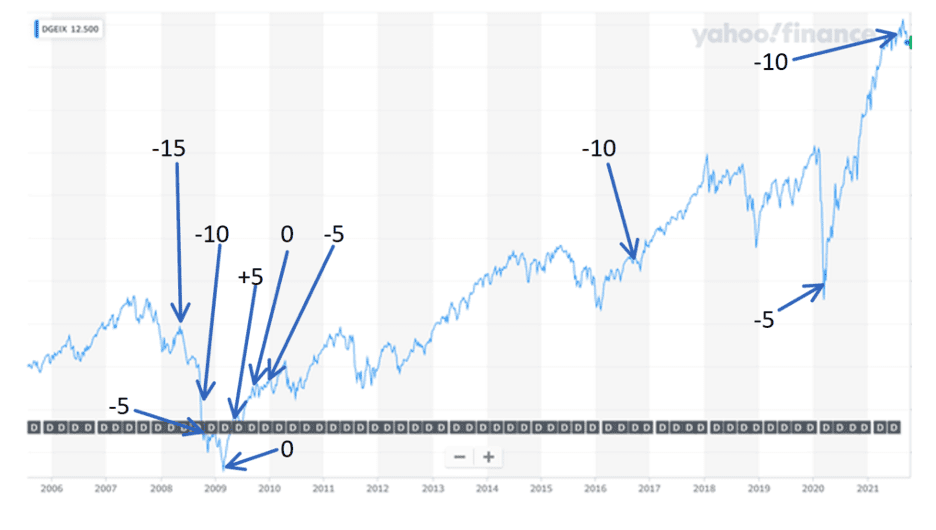

Once a decision is made on baseline portfolio, we can implement tools to help monitor and adjust the portfolio when opportunities arise. We utilize a methodology called opportunistic rebalancing to capitalize on short term market swings. By establishing a 20% tolerance band around each asset class, we can allow the asset in the portfolio to float until it hits the band. Then we will buy and sell as needed. The theory comes from the old adage: buy low and sell high.

Market Pricing Adjustment

By comparing what investors are currently paying for stocks to what they have historically paid for stocks, we can evaluate the current pricing of the market. This can help give perspective on current market conditions based on objective data rather than speculation or guessing. We can then make adjustments to the portfolio in 5% increments up or down based on the pricing of the markets.

Summary

Implementing these tools creates a process for making decisions around your portfolio without relying on behavior or emotions. These tools and practices can add value and protect your portfolio. If you are interested in learning more about our investment philosophy and tools, contact TPC or your TPC Financial Planner to set up a meeting.

Matt Knoll, CFP®,, is a Sr. Financial Planner in the Quad Cities office of The Planning Center, a fee-only financial planning and wealth management firm. Email him at mattk@theplanningcenter.com.