Top 11 Best Chicago Financial Advisors

TPC is honored to be listed among the top 11 financial advisors in Chicago, Illinois, according to Advisory HQ’s 2022-2023 list. TPC was rated as one of the top companies in Chicago to consider partnering with when planning your financial future.

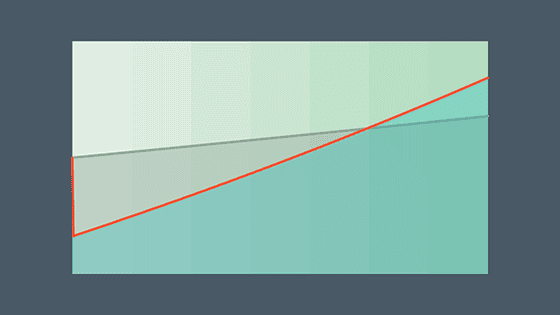

Rising Rates: Short-Term Pain for Long-Term Gain?

Investors have likely noticed the improved opportunity set in fixed income due to higher yields. And yet some investors may be hesitant to take advantage of higher yields because of concerns about future increases in yields. Some may even be considering reducing their bond exposure after this year’s negative returns for fixed income.1 The good […]

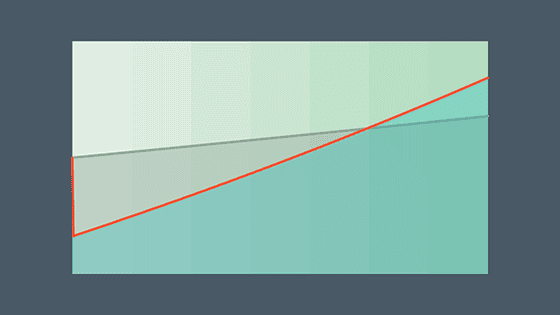

The 60/40 Portfolio: Down but Not Out

This has been a challenging year for investors. On top of the equity bear market, the steep losses in bonds1 have been especially surprising, leading some investors to question whether the classic 60/40 portfolio is dead. Although 2022 has seen the worst start to a year in history for many bond indices,1 the year-to-date experience […]

TPC Connected at the TPC Company-Wide Retreat

Andy Baxley, CRP®, CIMA®, Sr Financial Planner This particular retreat was special because it was the first time since 2019’s gathering in Stillwater, MN that we were all able to be together in person. After countless Zoom meetings, emails, and Slack messages sent back and forth these past couple of years, it was wonderful to […]

Cicily Maton’s Retirement: The Generational & TPC Planner Legacy Transfer

Eric Kies, CFP®, CEO/CCO/Sr. FP After a stellar career, our friend and colleague, Cicily Maton, CFR®, CeFT®, Senior Financial Planner, will be retiring in January, 2023. For those of you who’ve had the pleasure of working with Cicily, it’ll come as no surprise that she’s thoroughly prepared both her clients and colleagues for this change. In […]

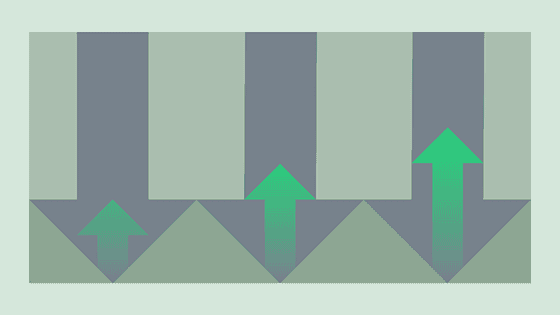

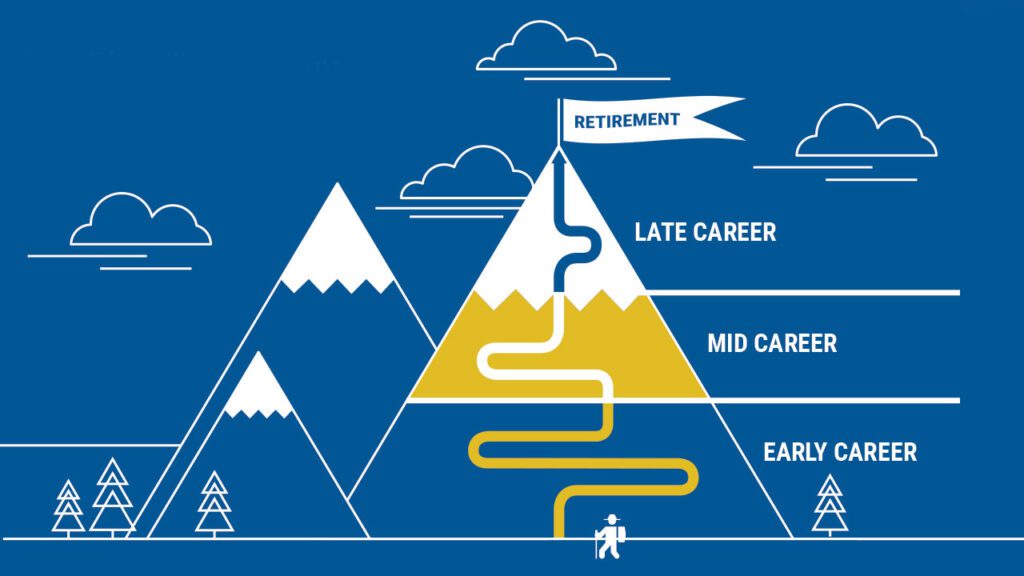

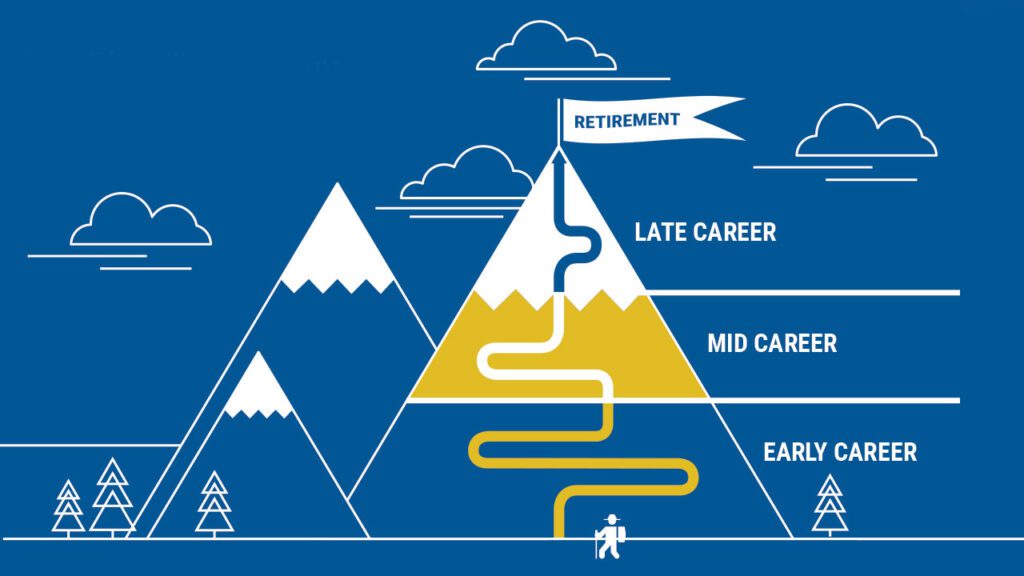

The Building Blocks of a Retirement Tier

When employees think about what it means to have enough money to retire, more than likely they are unsure how to translate their lifetime savings into income. For their entire working life, these employees receive regular paychecks; from this income, they generally construct a budget to cover their basic expenses. At the point of retirement, […]

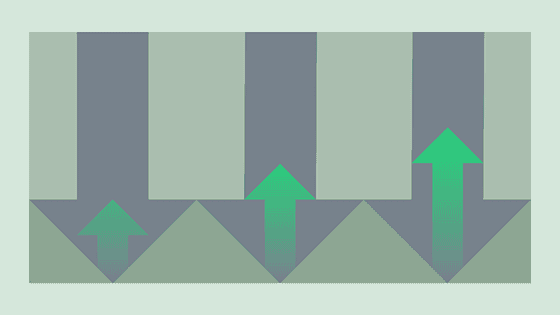

Four Ways to Improve the Probability of a Good Retirement

Around the world, individuals are being asked to take on greater responsibility for their own retirement. In the US, for example, a combination of limited Social Security funding and a reduction in the number of defined benefit (DB) employer plans—historically, the primary retirement savings vehicle for many—is causing investors to make decisions they have never […]

Your Money, Your Mind and Your Investment Method

Matt Knoll, CFP®, Sr. Financial Planner, Illinois It’s easier now than it’s ever been for people to play the stock market. Simply download an app and you can buy and sell stocks from your smartphone. The plethora of financial news programs on cable provide a steady stream of real-time updates that make us all feel […]

How to Solve the Retirement Income Puzzle

By Michael Branham, CFP® Sr. Financial Planner, Alaska In 2020, the Federal Reserve released a poll in which people were surveyed about whether they were on track to save enough for retirement. Among respondents 45-59 years old, 44% believed they were on track and among those 60 and older, it was just 51%. The poll was […]

Midterm Elections—What Do They Mean for Markets?

It’s almost Election Day in the US once again. For those who need a brief civics refresher, every two years the full US House of Representatives and one-third of the Senate are up for reelection. While the outcomes of the elections are uncertain, one thing we can count on is that plenty of opinions and […]

How to Invest Better—and Live Better

It can be challenging to start a conversation about investing. That’s why I encourage having a conversation before the investing conversation—what I like to think of as a “preamble.” Connecting life principles to investment principles is a powerful way toground abstract principles in reality, and to connect over universal experiences and feelings. It can also […]

Let’s Raise Money-Smart Kids!

Did you know that kids develop most of their money habits by age seven? Teaching our kids about money when they are young lays the foundation for responsible money management later in life. Children whose parents emphasize the importance of financial literacy and encourage them to spend and save mindfully, develop a healthy perspective on […]