This Has Been a Test: Developing a Financial Plan You Can Stick With

Think back to December 2019. The economy was humming. Unemployment, interest rates, and inflation were

People Have Memories. Markets Don’t.

One of the best things about markets is that they don’t have memories. They don’t

7 Steps to Take When You’ve Received an Inheritance

Andy Baxley, CFP®, CIMA®, Sr Financial Planner Here at The Planning Center, we focus a

TPC New Orleans Named One of the Best Financial Advisors

Our TPC New Orleans office is honored to have been named one of the finest

Trust the Financial Advisor Who Trusts the Market

With over 200,000 financial advisors in the United States, how do you pick one? First,

10 Attributes of Great Financial Advisors

Dimensional has been working with financial advisors for more than three decades. To recognize the

4 Smart Financial Steps to Make Life Easier for Loved Ones When You’re Gone

Andrew Sivertsen, CFP®, EA, CeFT®, Sr Financial Planner “On a long enough timeline, the survival

Why, When, and How to Talk With Your Children About Your Finances

Andy Baxley, CFP®, CIMA®, Sr Financial Planner Talking openly and honestly about our financial affairs

Top 11 Best Chicago Financial Advisors

TPC is honored to be listed among the top 11 financial advisors in Chicago, Illinois,

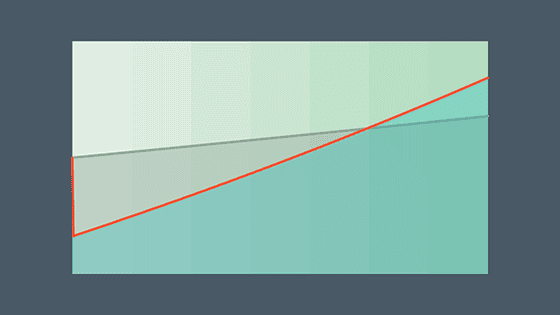

Rising Rates: Short-Term Pain for Long-Term Gain?

Investors have likely noticed the improved opportunity set in fixed income due to higher yields.

The 60/40 Portfolio: Down but Not Out

This has been a challenging year for investors. On top of the equity bear market,

TPC Connected at the TPC Company-Wide Retreat

Andy Baxley, CRP®, CIMA®, Sr Financial Planner This particular retreat was special because it was