There has been much debate in recent years about the State of Alaska’s ability to attract and retain talent for state government jobs. One of the biggest issues to address is how employees receive benefits in their retirement years. The state has a tiered employee system based on the date of hire, and the benefits for which you are eligible are affected by your employee “tier”. Your tier, and the associated benefits, may differ depending on whether you are a member of PERS (Public Employees’ Retirement System) or TRS (Teachers’ Retirement System).

I outline the retirement benefits for the Defined Contribution Retirement Plan (DCR; PERS tier IV and TRS tier III) employees in a separate article, <provide link> focusing here on PERS tiers I-III and TRS tiers I-II employees. There are some nuances we won’t cover here, so it’s always best to consult the official information* on the Division of Retirement and Benefits, or DRB, page(s) on the State website.

State employees hired before July 1, 2006, fall under the qualification of “Defined Benefit” for State of Alaska retirement benefits. So, what do you have available under these classifications, and how might you supplement those plans with savings outside of the workplace?

Defined Contribution Plan- Otherwise known as your pension benefit, this is intended to provide lifetime income after your working years, with a benefit amount paid monthly. This benefit is subject to taxes, and you may see additional deductions depending on what benefits you choose upon your retirement (survivor benefit, long-term care, etc.). As outlined in the State’s DRB retirement plan booklet, contributions from your paycheck and the State will depend on your employment class and system:

PERS (non-peace officer or firefighter)- You contribute 6.75% of your eligible salary.

PERS (peace officer or firefighter)- You contribute 7.5% of your eligible salary.

TRS- You contribute 8.65% of your base salary, up to the maximum allowed.

Your employee contribution account balance earns 4.5% annually within the plan (paid semi-annually for PERS and annually for TRS).

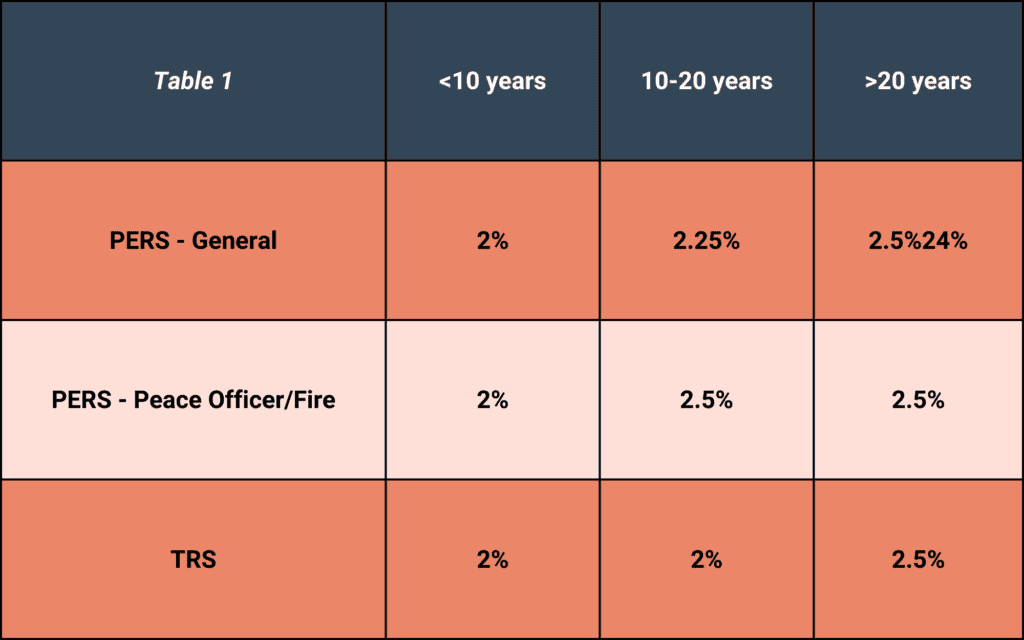

The State of Alaska contributes each year based on its plan actuarial funding requirements, which are held in a separate account for tracking purposes. The state’s contribution will consider service credits and average monthly salary and varies by employment classification and department within the state. You accrue percentage multipliers over your career, which are then applied to an average of your highest 3 salary years (all PERS tiers I-II, and PERS tier III peace officers or firefighters and TRS tiers I-II) or highest 5 salary years (PERS tier III, excluding peace officers and firefighters), as follows:

For example, based on this table, a general Tier I or II PERS employee with 18 years of service credit will be eligible for a benefit equal to 38% of their average highest 3 annual salaries. This is 20% for the first 10 years (10 years x 2%) plus 18% for the last 8 years (8 years x 2.25%).

In addition to benefit calculations, there are numerous stipulations for pension vesting, and the date at which you can take a full benefit (vs. a reduced benefit) depends on several different criteria. While we won’t include those details here, you can find them under the Pension Benefit Eligibility and Calculation section of the DB handbook linked above.

You should receive an annual statement each fall providing you with information on your accrued benefits and how they may be paid out at a future date. It’s a good idea to review this annually to ensure accuracy.

Supplemental Annuity Plan (SBS)– This plan is effectively your replacement for Social Security, which the State of Alaska opted out of beginning Jan 1, 1980. Social Security, a federal plan, guarantees a monthly income for the remainder of the recipient’s life, but the SBS account, a state-sponsored plan, will have to be managed effectively to provide similar income over a similar period.

The contribution amounts for the SBS are consistent across employment tiers, with 6.13% of your wages matched by a 6.13% contribution from the State, up to the Social Security maximum wage base (which changes annually). In total, you’ll have 12.26% of your annual income contributed to this account.

How you choose to handle this account in retirement is also important, so consult your planner or financial professional to discuss the available options. Every dollar distributed will be subject to federal income tax, and there will be Required Minimum Distributions starting at the stipulated age (currently age 73).

Deferred Compensation Plan– This plan is governed by IRC Section 457, but is akin to a private sector 401(k) plan. The Deferred Comp plan has similar annual contribution limits to a 401(k), with some differences related to “catch-up” contribution options.

So far, you’ve contributed 12.87% – 14.78% of your total income to retirement accounts depending on your status in PERS or TRS. In addition, the state has contributed an additional 6.13% to your SBS and is accruing pension benefits on your behalf. If your monthly cash flow allows you the ability to make additional contributions to a retirement plan, the Deferred Comp plan may be a good option for you.

The contributions can be pre-tax, but the plan also has an after-tax (or Roth) option. It’s always good to consult your financial professional when deciding which of these options is best based on your circumstances. Utilizing this plan can help ensure you have the necessary wealth to fund your retirement at the end of your career.

Generally Applicable:

Survivor Benefits- Upon your decision to begin the pension benefits, you’ll be asked about whether you’d like a percentage of your pension to be payable to a beneficiary (typically a spouse). While everyone’s situation is unique, it’s typical to opt-in to some level of survivor benefit. Please consult your financial professional to discuss this further.

Cost of Living Adjustment (COLA)– In retirement, you may be eligible for annual increases to your pension benefit. The State of Alaska could make two separate adjustments: a Cost of Living Adjustment (COLA) and Post-Retirement Pension Adjustments (PRPA). We’ll address these further in our synopsis for retired state employees, but you can consult the state’s website for more information.

Investment Options– The SBS and Deferred Compensation plans are considered participant-directed accounts. You can choose the investments on your own (limited to the options available within the plan) or utilize the fund management options offered. You can also engage a financial professional to discuss how to best allocate your current account balance and future contributions. For the most part, you’ll see similar investments available between all three plans, though there are some minor differences.

Fees– The State of Alaska has done a good job of building plans with low internal costs (the same cannot always be said for private-sector retirement plans). The SBS and Deferred Comp accounts have a 0.11% annual fee, plus the internal investment option fees. The Deferred Comp plan also has a $35 annual administration fee for actively contributing employees ($25 annually for non-contributing employees).

Vesting– For both the SBS and Deferred Compensation accounts, your contributions are 100% vested immediately.

Taxes– Most of the funds saved to these plan options are pre-tax, which means they’ll be fully taxable upon withdrawal from the account. The exception would be the Roth option within the Deferred Comp plan. Consult with your financial professionals to develop the appropriate distribution plan for your circumstances.

Other Savings– While not unique to your state employment, there are several other savings options available for you to meet your goals. Whether you contribute to an IRA, a Roth IRA, save with a traditional brokerage account, or utilize one of the many other savings vehicles at your disposal, planning for your future is vital to achieving the financial independence that most seek. Integrating your employer retirement accounts with any “outside” savings is critical to your financial plan.

Please Note– There may be nuanced differences in your benefits depending on your employment class and whether/which union contract may apply. Please utilize the resources provided by the State of Alaska and/or your Union to supplement this information. This can be particularly true with health benefits, life insurance coverages, and other ancillary benefits for which you may be eligible.

As noted earlier, this is not an exhaustive analysis of each of the State of Alaska retirement plans but should give you an overview of the options for which you may be eligible. If you have questions or would like to consider a more comprehensive discussion and planning work, please feel free to contact us for an exploratory conversation.