David Booth Long-Term Investment Strategy

Business Insider interviewed David Booth who says focusing on this long-term investing strategy will help you get the returns you’re expecting – and the ones you’re not.

The Right Thing, Not the Easy Thing

New entrants into the field of systematic investing must look for ways to differentiate themselves. Impressive backtested performance is one way to stand out. But are these backtests robust? Are they likely to withstand the challenges of real-world implementation? Historical returns can be noisy, and even small changes to how an experiment is run can […]

To Hedge or Not to Hedge?

Many investors take a global perspective when building portfolios to achieve their investment goals. With the benefits of greater diversification and an expanded opportunity set come exposure to foreign currencies. For investors with unhedged foreign investments, when their home currency appreciates, it has a negative impact on returns; when it depreciates, the impact is positive. […]

Quarterly Market Review – 3rd Qtr 2020

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The Planning Center, is a fee-only financial planning and wealth management firm. Email us at clientservices@theplanningcenter.com.

Is the Stock Market Divorced from Reality

I have been sheltering in place on a former dairy farm in rural New Hampshire—surrounded by more Scotch Highland cattle than people—and relying on my iPhone and Microsoft Surface Pro to keep in touch with the office via email and Zoom video. I haven’t sat in a restaurant in six months, so my dining […]

An Exceptional Value Premium

It’s probably not news to most value investors that the value premium has struggled over the past decade. What might be news is just how extreme an outlier recent value stock underperformance represents. The periodic returns for value versus growth in Exhibit 1 convey a stark contrast between recent years and the longer run of […]

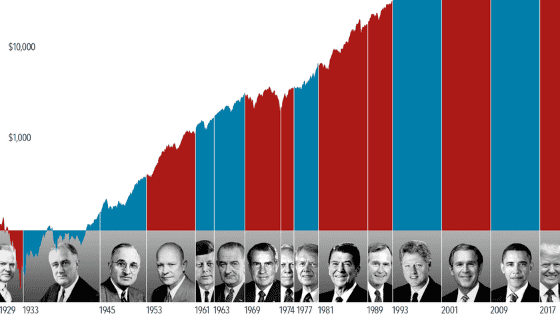

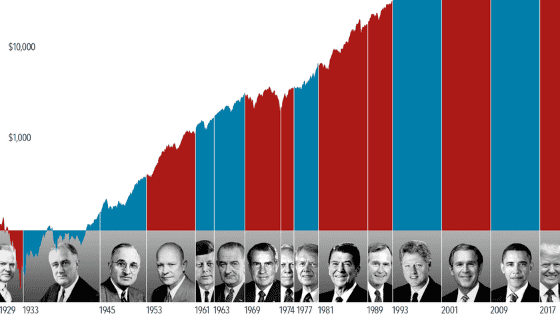

How Much Impact Does the President Have on Stocks?

The anticipation building up to elections for president often brings with it questions about how financial markets will respond. But the outcome of an election is only one of many inputs to the market. Our interactive exhibit examines market and economic data for nearly 100 years of US presidential terms and shows a consistent upward march […]

Ins and Outs of Emerging Markets Investing: Market Behavior and Evolution

Emerging markets are an important part of a well-diversified global equity portfolio. However, recent history reminds us that they can be volatile and can perform differently than developed markets. In this article, we provide a longer historical perspective on the performance of emerging markets and the countries that constitute them. We also describe the emerging […]

Investing with Dimensional in a Mutual Fund versus Exchange-Traded Fund

Dimensional recently announced plans to launch three actively managed exchange-traded funds (ETFs) later this year, complementing our existing suite of mutual funds, separate accounts, and commingled trusts. The introduction of Dimensional ETFs will provide investors greater choice in accessing Dimensional’s systematic investment approach. ETFs are often compared and contrasted with mutual funds. Our approach to […]

Taking Stock of Lump-Sum Investing vs. Dollar-Cost Averaging

Some investors favor a dollar-cost averaging (DCA) approach to deploying their investment capital. Unlike lump-sum investing, in which the full amount of available capital is invested up front, DCA spreads out investment contributions using installments over time. The appeal of DCA is the perception that it helps investors “diversify” the cost of entry into the […]

What to do if you’re waiting for COVID-19 test results

There are instructions for people who have symptoms and people who do not have symptoms.

Professor Kenneth French explains key principles of a successful investing experience

The Difficulty of Timing the Market Most people who try to time the market are just fooling themselves, says Prof. Ken French. Here he explains what it takes to beat the market. How to Think About Investment Risk Prof. Ken French explains that for most investors, the best definition of risk is uncertainty about lifetime […]