The earliest stock exchange dates to 17th century Amsterdam and the various East India Trading companies, but it took hundreds of years of economic and technological advancements for equity investments to become widely accessible.

There were many important milestones along the way— the first modern mutual fund in 1924, the first index fund in 1971, and the rise of the exchange-traded fund (ETF) in the 21st century (to name just a few).

Today, virtually anyone with a few dollars to spare can be an active participant in the global markets. It has never been easier to become a do-it-yourself investor.

To the surprise of many, it remains as difficult as ever to be a successful DIY investor.

Acknowledging that “successful” investing is a highly subjective term, I will supply a definition— a successful investor is one who has clear goals, a thoughtfully designed and well-executed strategy, and the ability to avoid most major errors in judgement along the way (e.g., panic selling).

Despite widespread accessibility and an endless sea of information to base our decisions upon, long term investment success as I’ve defined remains an elusive proposition for many.

Why might this be?

I believe the answer boils down to two factors— the knowledge gap and the behavior gap.

The Knowledge Gap

Successful DIY investing requires a certain baseline level of knowledge. To design a sensible portfolio, we must first understand the relevance and application of key concepts such as allocation, diversification, asset classes, risk, inflation, and correlation.

Thanks to the internet, investors have access to more information than ever before. Whereas someone in the 1970s may have struggled to get enough information to build a sensible portfolio, the modern investor suffers from the opposite affliction. We are buried up to our necks in information and, more critically, misinformation.

To quote Fox Mulder, “the truth is out there”, but we must know where to look and be vigilant to avoid faulty thinking and false promises along the way.

Bridging the knowledge gap requires that we learn the right lessons about investing. It’s a matter of quality, not quantity.

The Behavior Gap

The “behavior gap”, a term coined by author Carl Richards, is the difference between the rates of return that investment vehicles produce and the rates of return that investors in those vehicles actually earn.

Why is there a difference between the two?

The answer lies in a simple, inconvenient truth—we are hard-wired to misbehave and misjudge.

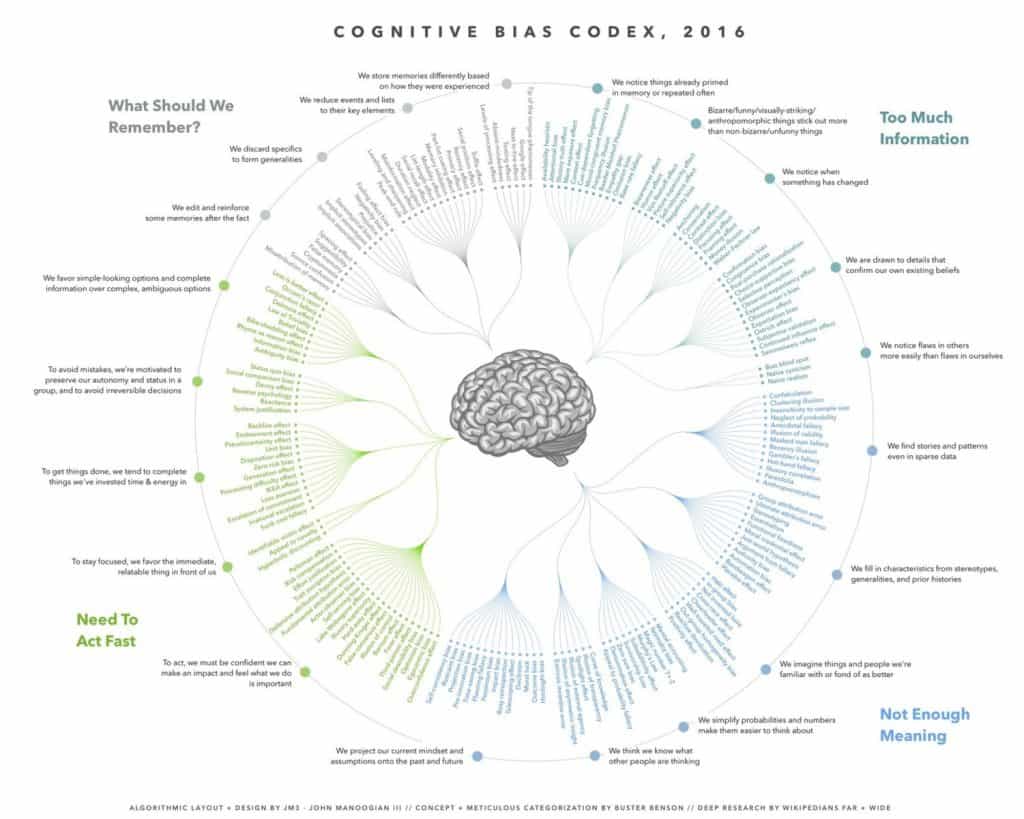

Our brains are beautifully complex systems evolved over millions of years, but they are far from perfect. Research from the field of behavioral economics has shown our internal decision-making mechanisms to be predictably and systematically faulty. The many ways in which our brains lead us astray have come to be called “cognitive biases”.

On the wall in my home office I have a beautiful poster that lists the 188 known cognitive biases.

A few of my favorites are—

- Confirmation bias—focusing on information that confirms pre-existing beliefs while ignoring information that challenges those beliefs.

- Familiarity bias—favoring that which is familiar over that which is unfamiliar, regardless of merit.

- Self-attribution bias—attributing successful outcomes to our own actions and unsuccessful outcomes to forces beyond our control.

- Herding bias—the urge to mimic the crowd, even when the crowd is leading us over the proverbial cliff.

- IKEA effect—placing a disproportionately high value on something we built or put together ourselves.

And my personal favorite—

- Blind spot bias— the tendency to recognize cognitive biases in others while failing to identify our own.

It’s both unsettling and reassuring to learn that everyone—you, me, even Warren Buffet himself—is prone to cognitive biases and faulty decision making. That said, we are not all prone to a given bias to the same degree.

It’s up to each one of us to learn which specific biases we’re most likely to fall prey to. This critical self-knowledge represents an essential chapter in your brain’s owner’s manual.

—

To successfully navigate the investment wilderness, we must find a way to bridge the gaps in our understanding and decision making. This is difficult to do without the support of a skilled guide. After all, we don’t know what we don’t know.

Fortunately, you don’t have to go it alone. We’ve been helping clients build, implement, and maintain successful investment strategies for decades. If you’re interested in hiring a guide for your investment journey, we’d love to talk with you.