Navigating Geopolitical Events

GLOBAL DEVELOPMENTS AND THEIR IMPACT Geopolitical events like military or economic conflicts can affect stock markets in many ways. These events are normally widely followed by investors. We believe current market prices quickly incorporate expectations about the effects of these events on economies and companies. Our investment approach centers on using information in current market […]

Is $22 Trillion a Tipping Point?

KEY TAKEAWAYS National debt is generally a slow-moving variable whose expected value should be incorporated in market prices. The evidence suggests there has not been a strong relation between country debt and equity market returns. The challenge of trying to outguess the markets based on macroeconomic indicators can come at the opportunity cost of missing […]

Why a Stock Peak Isn’t a Cliff

Many investors may think a market high is a signal stocks are overvalued or have reached a ceiling. But they may be surprised to find out that the average returns for the S&P 500 Index one, three, and five years after a new market high are similar to the average returns for the index over […]

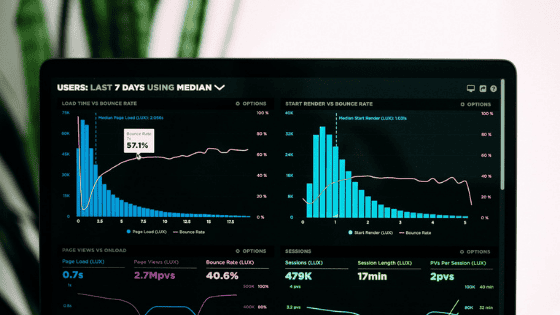

Market Review 2021: A Recovery Amid Challenges

KEY TAKEAWAYS Stock markets continued to climb higher in 2021, with the S&P 500 hitting a series of all-time closing highs and ending the year near a record. While COVID-19 continued to dominate headlines, concerns also focused on inflation and its potential impact. Investors saw volatility in areas ranging from cryptocurrencies to so-called meme stocks, […]

ETF Options on the Rise in 529 Plans

Paul CurleyDirector of Savings Research, ISS Market Intelligence Paul Curley, CFA, is Director of Savings Research at ISS Market Intelligence. He oversees 529 and ABLE market data, research, events, and digital products and services for institutional clients, including the annual 529 Conference. He authors weekly, quarterly, and annual business intelligence publications on the college financial […]

Tuning Out the Noise

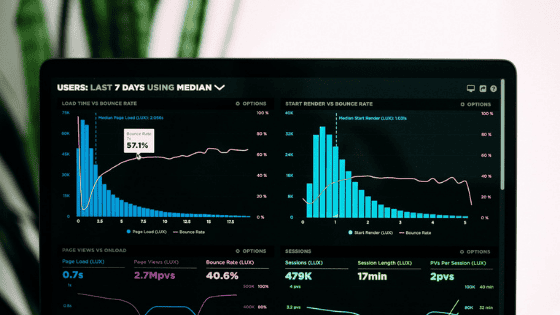

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting your financial well-being can evoke strong emotional responses from even the most experienced investors. Headlines from the so-called lost decade–the 2000s, when the S&P 500 ended below where it […]

Myth-Busting with Momentum: How to Pursue the Premium

Nearly 30 years after its formal discovery,1 the appeal of stock price momentum2 remains in the eye of the beholder. Some see its outsize historical premium, 9.1% per year in the US,3 as validation for investing in momentum-focused strategies. Others point to the extreme turnover and occasional catastrophic outcomes4 for the premium as insurmountable hurdles […]

All-Time-High Anxiety

KEY TAKEAWAYS Financial journalists periodically stoke investors’ record-high anxiety by suggesting the laws of physics apply to financial markets—that what goes up must come down. But shares are not heavy objects kept aloft through strenuous effort. They are perpetual claim tickets on companies’ earnings and dividends. If stocks have a positive expected return, reaching record […]

Do ESG Ratings Get High Marks?

KEY TAKEAWAYS As interest in ESG investing grows, so too do the ways in which it is measured and reported. ESG ratings providers frequently disagree on company ratings. Because ESG ratings often look at dozens of variables, and because detailed methodologies and score attributions are generally not publicly available, understanding where discrepancies come from can […]

Finding Your Balance: Tradeoffs and Decisions in Portfolio Rebalancing

Rebalancing can help investors maintain an asset allocation that aligns with their needs, goals, and risk tolerances. The appropriate approach to rebalancing depends on where an investor sits in the tradeoff between rebalancing costs1 and deviations from the target asset allocation. Evaluating an array of rebalancing methods using four decades of historical data, our recent […]

10 Obstacles to Investing—and How to Overcome Them

We’ve learned a lot about investing over the past 60 years, a period that has seen many breakthroughs in the world of finance. What we know comes from studying public markets and is grounded in serious academic research. The lessons are clear: Investing in markets is an excellent plan for meeting long-term goals, like […]

Alaska Business 2021 Power List Includes TPC Anchorage

The TPC Anchorage office is pleased to be included in the Alaska Business 2021 Power List. The list is created to help build professional relationships throughout the area. Read the Entire Article Here