Turn a Loss into a Win: Tips on Tax-Loss Harvesting

Through a technique known as “tax-loss harvesting,” recognizing a loss on an investment that is down in value can position you for future tax advantages as you manage your portfolio. Our article explains.

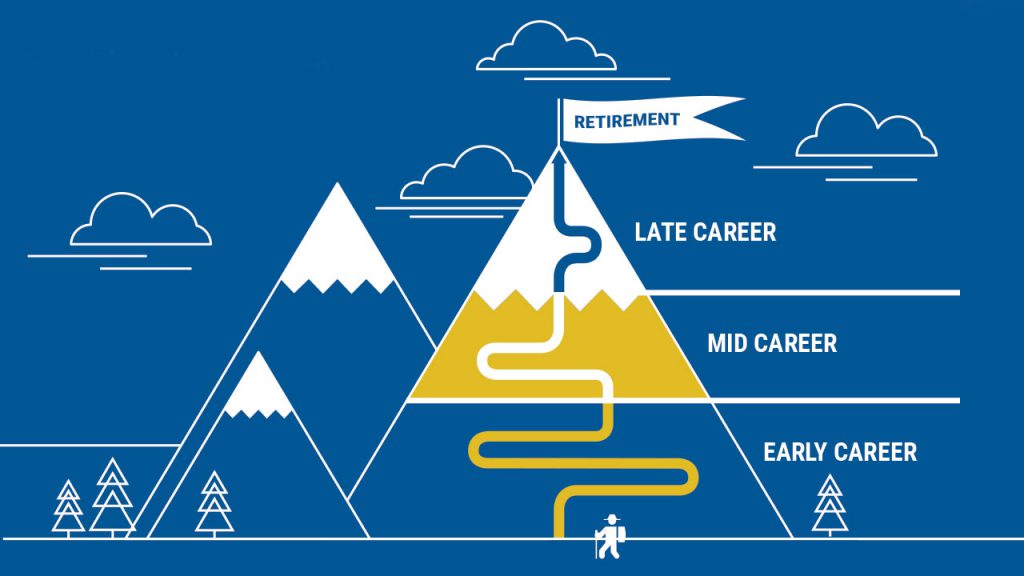

When Is “Retirement Age”? Well, It Depends…

“Retirement age” doesn’t mean the same thing it did twenty years ago—or even ten years ago. From the “FIRE” movement—with advocates focused on retiring in their 50s or younger—to those pursuing a “second act”—a second career following a full first career—retirement age has come to mean many different things to many different people. But what’s the right age for you? Our article can help you decide.

Are You Building Wealth, or Just Making Money?

An older businessman once asked a young associate what the term “financial independence” meant to him. The young man thought a moment, then replied, “It’s when your paycheck is always enough to take care of your expenses.” The older man smiled and shook his head. “Financial independence,” he said, “is when it doesn’t matter whether you get a paycheck or not.”

Maximizing Your Executive Compensation Package

The nuances of executive compensation require careful attention to some specific elements and potential issues. Let’s talk about some of the basics of executive compensation, how they might fit into your long-term financial strategy, and some particular matters that deserve specific focus.

Top Tips for Small Business Owners to Organize Tax Records

By Caleb Arringdale,Tax Advisor For some small business owners, tax season is the time of

How to Keep Good Records for Your Personal Taxes

By Caleb Arringdale,Tax Advisor Probably the biggest reason people get stressed about doing their taxes

The Financial Planning A-Team Includes Your Tax Advisor

By Caleb Arringdale,Tax Advisor Some believe that the financial planning industry is unnecessary and choose

Tax Burn: When to Not Share the Wealth with Family

By Caleb Arringdale,Tax Advisor While sharing the wealth during your lifetime can be a great

Sharing the Wealth – Tax Free Ways to Gift to Children

By Caleb Arringdale If you have children or grandchildren, there are good reasons for choosing

Understanding Your Stock’s Cost Basis

By Matt Knoll, CFP® & Caleb Arringdale, EA What is Cost Basis? Cost basis is the original value

Simplifying Tax Planning for Retirees

Caleb Arringdale, TPC Tax Advisor, recently presented “Simplifying Tax Planning for Retirees” as part of

Extra Identity Protection PINs Available for all Taxpayers

By Caleb Arringdale Several years ago, the IRS instituted a program to help identity