You may have noticed changes in the bonds you hold in your taxable accounts (not retirement accounts like IRA’s). Don’t be alarmed if you see new fixed income investment names or symbols or receive prospectus information on a few new fixed income funds. This is all normal and part of something called tax-loss harvesting we are doing in response to bonds being down over the past year.

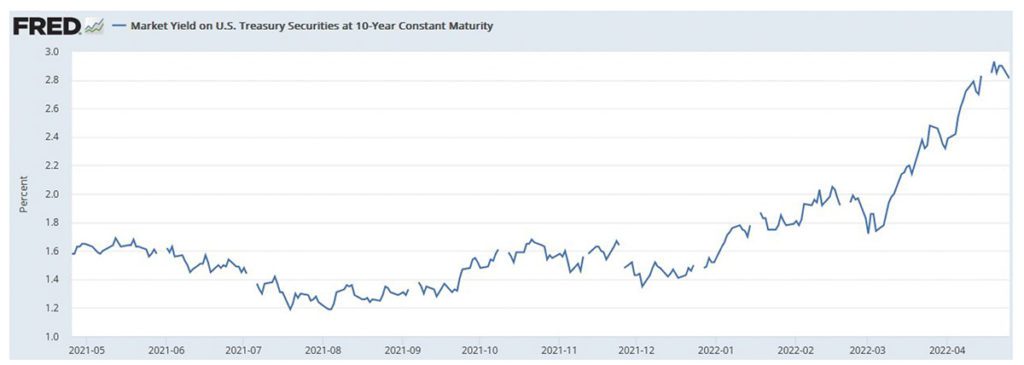

Bond prices have been going down steadily for the past year primarily driven by rising interest rates.

To understand why this happens, let’s look at the relationship between interest rates and bond prices. Most bonds pay a fixed interest rate. When interest rates go up as they have recently, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price*.

The chart below shows the 10-year U.S. treasury yield has nearly doubled in the past year.

Tax-loss harvesting is when we sell the bonds to realize a loss and use that loss to offset gains in the portfolio to try and reduce overall taxable income.

You will still be invested in bonds, but the names of the investments may look a bit different than what you are used to seeing.

If you have additional questions, please contact your TPC team.