Because innovation is the lifeblood of the worldwide economy, it may not be surprising that the financial markets are always looking toward “the next big thing.” For a few years now, that “big thing” is artificial intelligence, or AI. Companies like chipmaker NVIDIA, search engine giant Alphabet (parent company of Google), software developer Microsoft, and others have come to dominate the capitalization of the American equities markets. At this writing, the so-called “Magnificent Seven”—NVIDIA, Microsoft, Apple, Alphabet, Amazon, Meta (parent of Facebook and Instagram), and Tesla—account for more than 35% of the total value of all companies making up the S&P 500 index (in other words, the other 65% is spread among the other 493 companies in the index).

It’s understandable, then, that many investors may be asking themselves, “How can I get in on the AI boom? Should I be owning more of these stocks?”

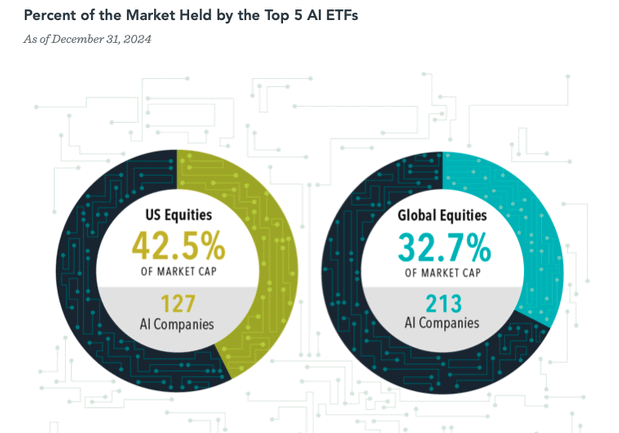

The short answer is, they probably already do. In all likelihood, investors with well-diversified equity portfolios already have exposure, mainly because AI tools touch nearly every type of business these days. Holdings of the five largest AI exchange-traded funds (ETFs) collectively span a sizable chunk of the market: 42.5% of US stock market capitalization and 32.7% of global market capitalization. And it’s not just a few big companies like NVIDIA or Apple. In the US alone,127 companies are included among these AI-focused strategies. Certainly, the “usual suspects” from technology are well represented (all five of the ETFs hold NVIDIA), but less tech-forward names like Caterpillar, Honeywell, and Thomson Reuters can also be found within these ETFs.

SOURCE: Dimensional Fund Advisors. Holdings of funds are subject to change.

In other words, “The Magnificent Seven,” while important, are not the entirety of the AI landscape. This exemplifies how AI is likely to touch virtually every business type, making it harder to predict the ultimate winners from the revolution. It also underlines once again the importance of maintaining a diversified portfolio, rather than trying to concentrate on only a certain sector that may be “hot” today but subject to a rapid cooldown at a later time. Diversification is also a reliable tool for investors who want to dampen the price volatility that often characterizes highly concentrated positions. Broad diversification can help investors avoid missing out on these winners, wherever they show up, and can also ease the effect when certain sectors are less in favor.

The bottom line is that investors who want to benefit from expected gains should continue to hold diversified portfolios of assets that match their most important objectives. Rather than attempting to outguess the market and pick “the next big thing,” most investors should maintain broad exposure, trusting in the market’s historically demonstrated ability to incorporate the latest innovations in humanity’s never-ending need for progress.

At The Planning Center, we know how important it is for investors to be well-informed about developing market trends, the economy, and other vital financial data. If you have questions about the impact of AI or any other trend on your portfolio, we are here to help you find the answers you need.