What We Do

“We uncomplicate the complicated”

– Marty Kurtz, Founder, CFP®

More About TPC

The Planning Center is a fee-only financial planning firm that provides a safe place for you to discuss what matters most to you and your family with a team of trusted financial advisors.

We believe that all financial decisions are emotional decisions, and in order to make more effective decisions, everyone could use an objective third party to talk about life and money.

Our goal is to help you make better decisions as you navigate life’s transitions and guide you toward the life you would like to have.

Over time, your needs will evolve. The transitions you experience in life–marriage and family, wealth accumulation, your career–require an evolving perspective on priorities, strategies, and goals. We incorporate this growth into your plan. We can analyze your situation and help manage your financial options to keep you organized and on course. Whatever stage of life you are in, we have the tools and knowledge to support you every step of the way.

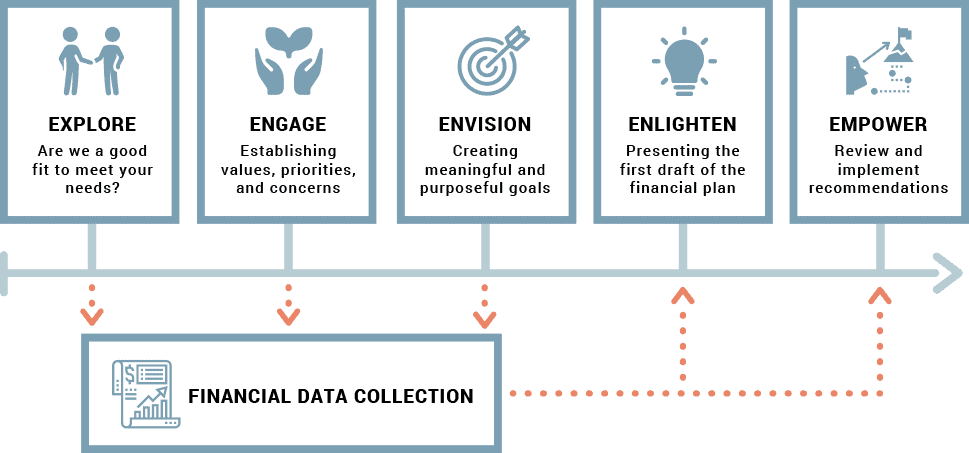

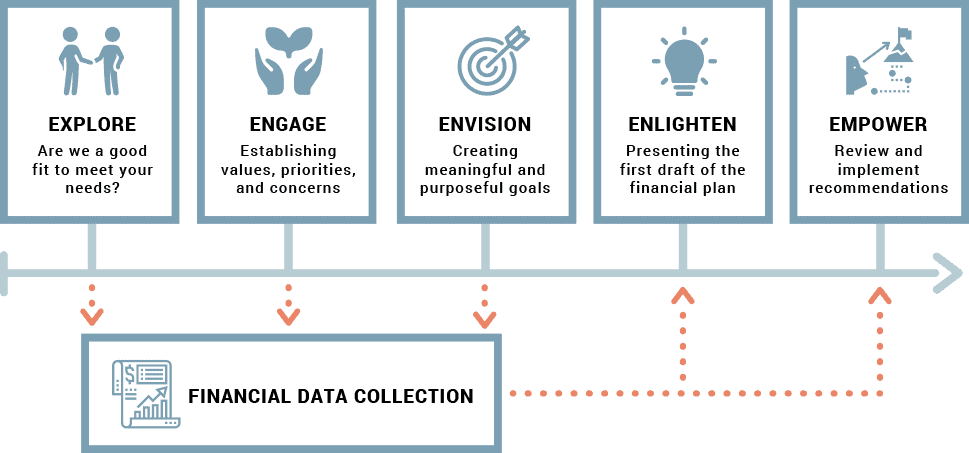

What to Expect

Our financial planning process begins with you. We’ll organize your current financial situation and set expectations and goals unique to your perspectives and wishes. With this shared understanding, we can discuss strategies and tactics to achieve your goals together.

Year One

TPC Independent Fee-Only Fiduciary Model

All of our financial planners adhere to an independent, fee-only, and fiduciary approach. Find out why those are important titles when discussing your personal finance.

Build Confidence In Your Financial Future

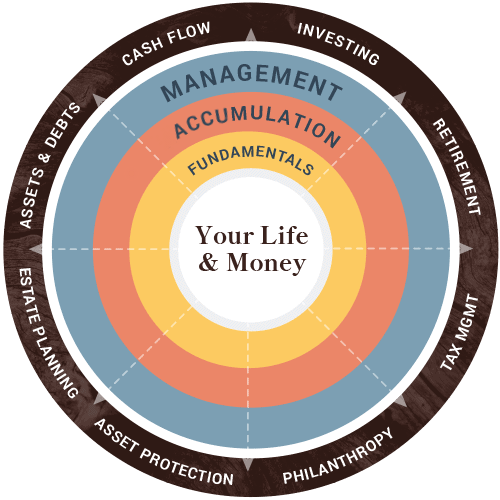

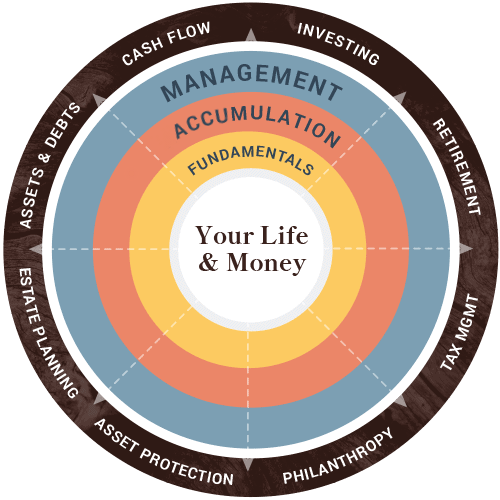

We believe that your wealth and life should be in balance. No matter what stage of life you are in, you are impacted by these eight financial categories. We will work with you to address issues and identify opportunities to track and grow your progress toward better wealth life balance.

In order to make a plan for the future, it helps to begin with a clear understanding of where you are today.

In this assessment process, some of the areas we evaluate together include:

Establish & Track Net Worth

Your net worth is defined as the assets you own minus any debts you owe. We will track this number continuously and use it as a barometer to measure your progress. You will grow your net worth over time through a combination of savings, debt reduction, and prudent investing.

Review Cash Reserves & Liquidity

Cash reserves are needed to prepare for unexpected bumps in the road. We will help determine how much liquidity you need and where it should be kept.

Assess Credit & Explore Possibilities

Some types of credit can be used for wealth creation, but others are destructive. We will help you determine how to utilize credit strategically and avoid common debt traps.

Planning for Business

Business planning begins with a review of your current entity structure, documents, and potential succession plans to anticipate any potential income or taxation complications. We will explore retirement plan options and help you choose the best one to meet your goals.

The journey to wealth begins with a single step, and that all-important first step is to establish a strategy for managing your cash flow.

In this assessment process, some of the areas we evaluate together include:

Establish Current Income Streams

Your current income streams provide the fuel for wealth creation and preservation. We first seek to understand these income sources, then create a plan for sustaining or growing them over time.

Discuss Irregular Income & Expenses

Certain types of income, such as bonuses, commissions, and stock options, require special planning to account for their complexity and irregularity. Likewise, significant expenses that do not follow a predictable pattern can compromise your plan if not properly accounted for. We will keep your plan on track by anticipating and preparing for these varying sources of income and expense.

Implement First Step Cash Management™

We will train you to use a cash flow system that simplifies and clarifies your decision-making process. By categorizing expenses into past commitments, present choices, and future needs & wants, you will establish an automated system for meeting your saving and spending goals.

Optimize Banking Structure

With some simple concepts and structures, we can line up bank accounts with automatic transfers to meet your needs and goals. Sometimes special considerations will need to be made for business owners or individuals with irregular income to smooth out the flow of cash at the bank.

Your investment portfolio is the engine that powers the growth of your wealth over time. We believe investment success is achieved through the implementation of rigorous, research-based portfolio management strategies designed around the unique needs of each client.

In this assessment process, some of the areas we evaluate together include:

Determine Risk Preference

Your investment portfolio should be a reflection of your financial needs and your comfort level with risk, which we will determine using a psychometric risk assessment. We will use this data to construct a portfolio designed to meet your financial goals while managing risk responsibly.

Construct a Portfolio

We construct globally diversified, tax-efficient portfolios consisting of low-cost exchange-traded funds and mutual funds from well-established investment companies. Drawing on decades of research from Nobel Prize winners Eugene Fama and Kenneth French, among others, we implement evidence-based strategies that have withstood the test of time. Though periods of short-term volatility are to be expected, stocks have historically rewarded patient, long-term investors.

Align Portfolio to Goals

We will help you define and plan for your short, medium, and long-term goals. Once your risk profile and goals are integrated into your plan, simulations will be run to determine whether you’re on track and how increases or decreases in risk might affect your outcomes.

Rebalance Assets

Over time, market conditions may cause certain investments to become overweight or underweight relative to their intended allocations. We monitor these changes carefully and bring the portfolio back into balance any time a given investment deviates significantly from its target. This strategy, known as opportunistic rebalancing, allows us to take advantage of volatility by capturing gains on assets that have increased in value and reallocating them to assets with more favorable pricing.

Monitor Market Pricing

In addition to monitoring and rebalancing each individual investment within the portfolios we manage, we keep a watchful eye on global market valuations. Using predetermined thresholds and well-established valuation measures, we reduce stock exposure incrementally when the market “overheats” and increase it when market pricing is more favorable for long-term returns. As with opportunistic rebalancing, this strategy is designed to reduce risk and portfolio volatility over time.

Adjust Allocation

We will schedule a regular review cycle to check in on your goals, objectives, and resources as they change over time. Updating the plan projections will help us to determine whether there is a need to adjust the portfolio allocation.

Sustainable Investing

We offer clients the ability to align their portfolios with their environmental values through our sustainable investment models. Guided by the latest research from environmental science, as well as an evidence-based investment thesis, these portfolios are designed with future generations in mind.

No matter how carefully you plan for the future, unexpected circumstances are often unavoidable. Fortunately, these challenges do not have to derail your carefully laid plans. A careful review of your insurance and benefits portfolio is the first step to ensuring that you and your family are protected and prepared to weather any storm.

In this assessment process, some of the areas we evaluate together include:

Life Insurance Needs Analysis

Your life insurance portfolio should be a reflection of your family’s unique needs. Effective planning in this area begins with one essential question- How would your loved ones be financially impacted if you were to pass away earlier than expected? Our process begins with a careful analysis to answer this question. From there, we create a plan to ensure your family’s financial security, no matter what.

Protecting Your Income (Disability Insurance)

When it comes to becoming too sick or hurt to work, many people think, “It won’t happen to me.” We will help you assess the risks, review current coverages, and determine if there is need remaining.

Health Insurance Strategies

We want to help you understand your coverage options, whether it be through a personal plan, employer plan, Medicare, or the Marketplace. In certain cases, we can help you obtain significant tax savings through the proper use of HSAs and FSAs, as well as optimization of Premium Tax Credits when buying insurance from the Marketplace.

Minimizing Long Term Care Risks

The cost of long term care has increased dramatically in recent years, and may continue to do so in years to come. No matter how well-prepared you are to cover your living expenses in retirement, it is essential to conduct a careful, clear-eyed assessment of your potential long term care needs. With this knowledge in hand, we will explore different ways to cover these costs should they arise.

Property & Casualty Coverage

You should have the peace of mind of knowing that your assets are adequately protected. We will help you identify gaps in your insurance portfolio and refer you to a trusted professional to obtain the coverage you need at a reasonable price.

Personal & Professional Liability

We will discuss liability risk from a personal and professional perspective. After reviewing any current policies, we can recommend a plan for coverage.

Benefits Review

Many employers offer a wide array of supplemental benefits as a part of their employees’ “total compensation” packages. Taking full advantage of these valuable benefits is an essential component of a well-rounded financial plan. We will conduct a comprehensive review of your employee benefits package to ensure your elections are properly aligned with your situation and goals.

The peace of mind that accompanies a well-crafted estate plan is one of the greatest gifts we can give our loved ones and ourselves. Planning for an organized estate not only helps to avoid probate and unnecessary taxes, it reduces stress and uncertainty for everyone involved.

In this assessment process, some of the areas we evaluate together include:

Establish & Review Documents

We will teach you the essentials of estate planning, demystifying often-misunderstood tools such as wills, trusts, powers of attorney, and buy-sell arrangements. We will work together with your attorney to create a strategy that aligns your estate plan with your wishes and the best interest of your family.

Review Beneficiary Designations

We will ensure that your retirement account and life insurance beneficiary designations are both tax-efficient and aligned with any special provisions for dependent minors. As life progresses, we’ll review your beneficiaries to make sure they remain updated as your family tree grows and evolves.

Optimize Asset Titling

Appropriate asset titling can simplify estate settlement and save thousands of dollars in probate and tax costs. We will assess the titling of your various assets to ensure that your plan is optimized for simplicity and cost-efficiency. Where needed, we will help you retitle accounts in accordance with the plan we’ve established together with your attorney.

Other Estate Concerns

We’re here to help as other estate-related needs and concerns arise. Whether it’s establishing end of life wishes, coordinating and assigning roles to key individuals, or navigating the emotional challenges that naturally arise throughout the estate planning process, we’ll be with you every step of the way.

Strategic giving is where your financial plan and your generosity intersect. We will work together to develop a gifting plan that is tax-efficient and built to make a lasting impact on the causes and organizations most important to you.

In this assessment process, some of the areas we evaluate together include:

Define Values & Goals

We will look at how you are allocating your time and money to various charitable efforts. Our hope is to help you prioritize what is going to make the biggest impact toward your goals.

Make a Giving Plan

We will outline which giving strategies are available to you and recommend a course of action that aligns with your intended goals. We will integrate these recommendations with your overall plan to ensure all strategies are properly coordinated.

Optimize Tax Efficiency

From Donor-Advised Funds to Trusts, Family Foundations, and more, there are a number of underutilized tools that typically reduce tax liability far better than writing a check to a charity. We will help you explore ideas to make sure your gifts are tax-efficient.

Collaborate with Experts

Many charitable strategies involve third parties, such as foundations, trustees, attorneys, accountants, fundraisers and more. We will be there to collaboratively lead the team so that you don’t have to.

How do we balance the need to save for the future with a desire to live for today?

In this assessment process, some of the areas we evaluate together include:

Set & Review Goals

We will work together to explore what is possible and craft a clear vision for the future, then set goals to make this vision a reality. Of course, setting goals is only the beginning. We provide the accountability and continued support to ensure you stay on track.

Track and Celebrate Progress

Building sustainable wealth isn’t easy, and it doesn’t happen overnight. It’s a stepwise journey that requires years of diligence and thoughtful planning. As with any adventure, it’s important to take a break every now and then to and celebrate how far you’ve come. We will help you track your progress and be there to celebrate every milestone along the way.

Run Financial Projections

We utilize advanced financial planning software that pulls together your expense needs, income sources, and assets to project a probability of success and inform our recommendations. By constantly updating the plan, we can determine when minor adjustments are needed to stay on track to meet your goals.

Commit to a Plan

We will be your thinking partner to brainstorm and strategize the best way to utilize financial instruments and tax efficient vehicles to achieve your goals. Together, we will prioritize your goals, then break them into measurable and attainable steps that can be tracked over time.

With the tax system constantly changing and increasing in complexity, clients realize the critical role that strategic tax planning plays in their overall financial plan. Effective tax planning simplifies, clarifies, and has the potential to dramatically reduce your lifetime tax liability.

In this assessment process, some of the areas we evaluate together include:

Review Prior Returns

Your tax return is like your financial DNA that gives us valuable insight into what is going on in your financial life. By reviewing your last two tax returns, we can look for tax arbitrage opportunities for the past and present.

Run Tax Projections

We will work closely with your CPA or one of our in house CPAs to run tax projections during the year. These projections will help us determine what strategies to utilize for minimizing annual and lifetime taxes and avoiding penalties.

Optimize Tax Strategies

We will help you stay relevant with current tax law to take advantage of credits, deductions, and proper utilization of pre-tax dollars to minimize today’s tax bill. In many circumstances, we may consider strategies that can greatly reduce your lifetime tax liability, and also that of future generations.

Prepare Tax Return

For those utilizing our in house CPAs, we will prepare and review your tax returns. This will help you organize your tax information and simplify the tax preparation process by having your planning, investments, and taxes under one roof.

We’d like to meet you!

Schedule a free 15 minute conversation and we’ll spend a few minutes getting to know each other so we can learn if what you are seeking and what we provide are a good fit for each other. If it seems like a fit, we’ll talk about next steps. If we’re not, we’ll help you find the right group for your needs.