This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The report also illustrates the impact of globally diversified portfolios.

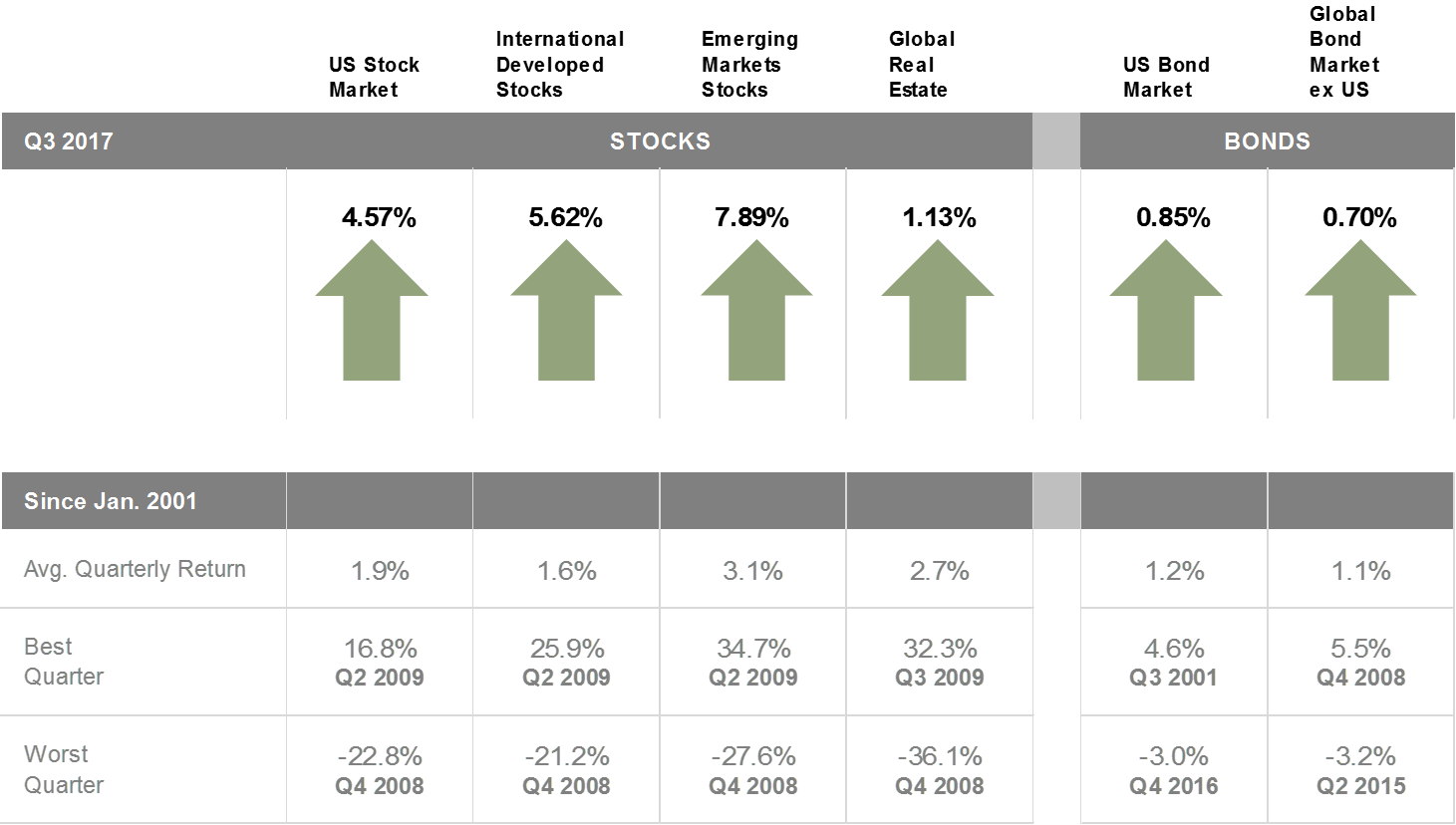

Market Summary

Index Returns

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond ex US Market (Citi WGBI ex USA 1−30 Years [Hedged to USD]). The S&P data are provided by Standard & Poor’s Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2017, all rights reserved. Bloomberg Barclays data provided by Bloomberg. Citi fixed income indices copyright 2017 by Citigroup.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond ex US Market (Citi WGBI ex USA 1−30 Years [Hedged to USD]). The S&P data are provided by Standard & Poor’s Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2017, all rights reserved. Bloomberg Barclays data provided by Bloomberg. Citi fixed income indices copyright 2017 by Citigroup.

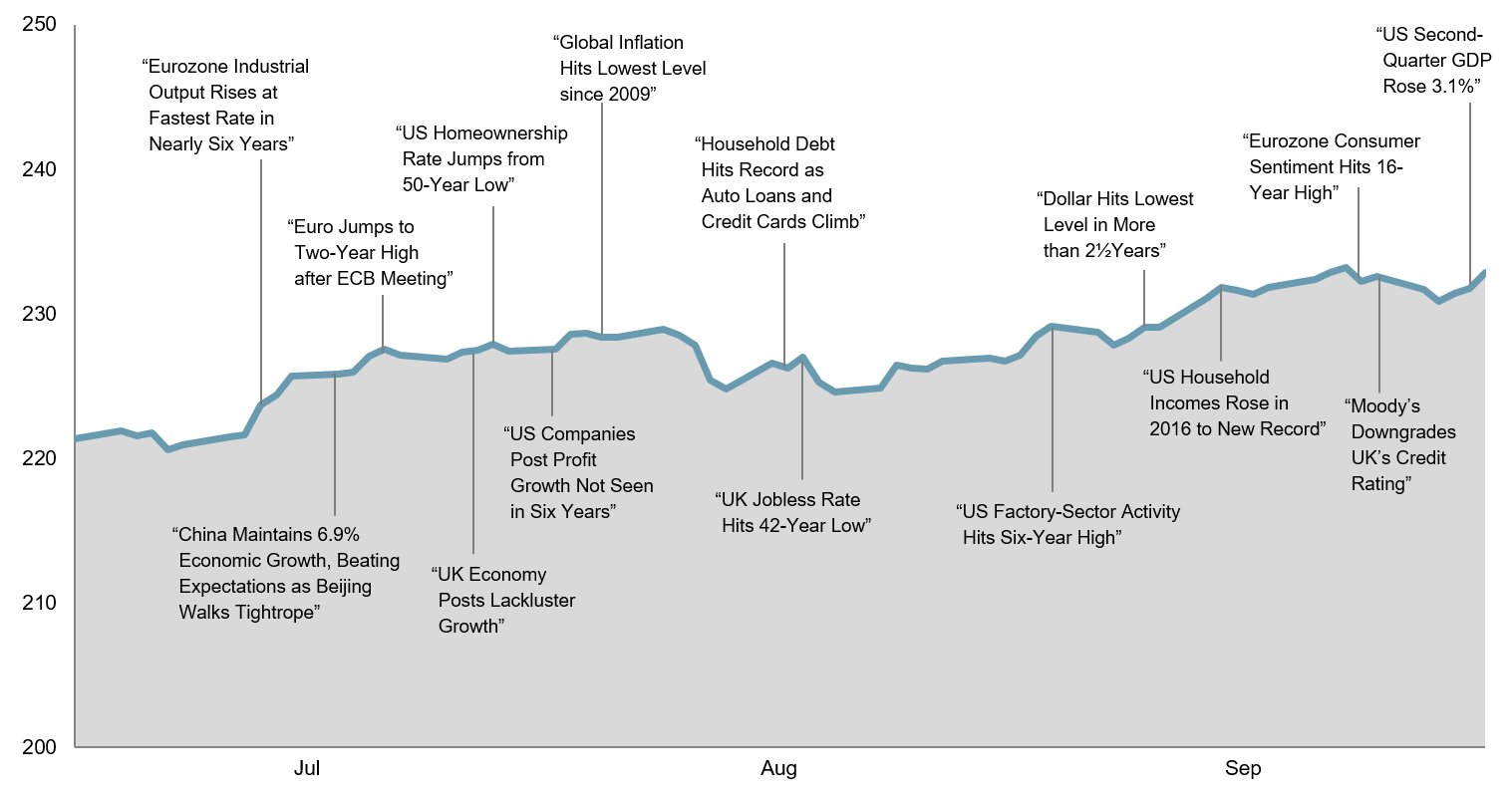

World Stock Market Performance

MSCI All Country World Index with selected headlines from Q3 2017

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.

Graph Source: MSCI ACWI Index [net div.]. MSCI data © MSCI 2017, all rights reserved. It is not possible to invest directly in an index. Performance does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results.

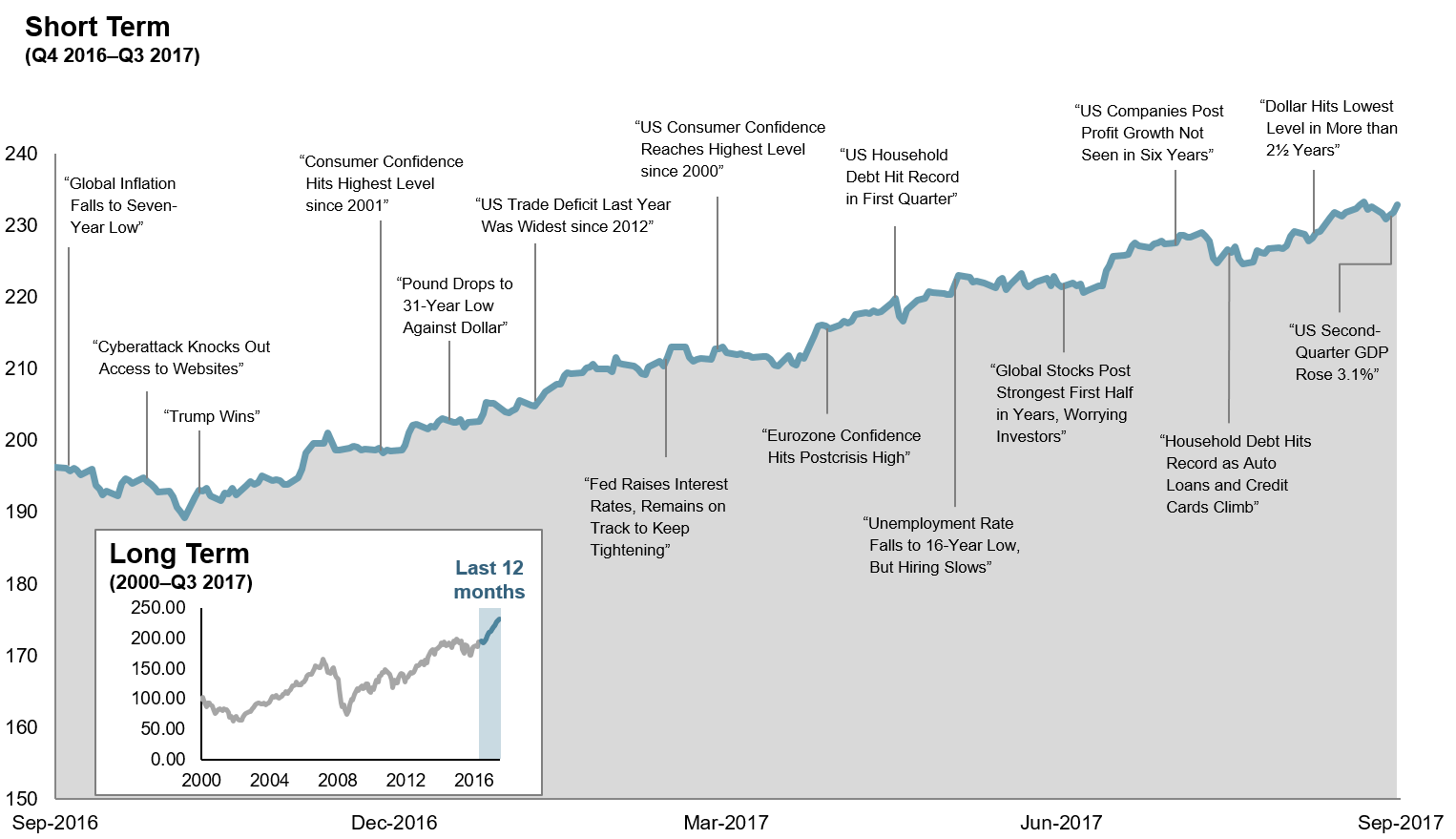

World Stock Market Performance

MSCI All Country World Index with selected headlines from past 12 months

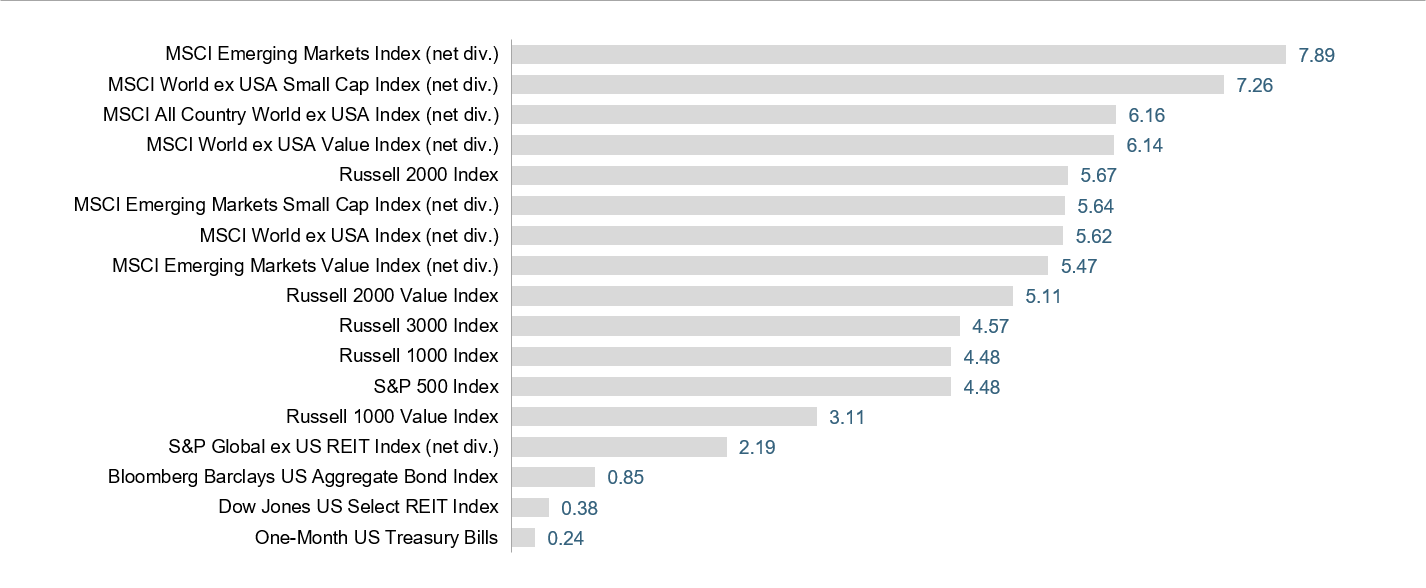

World Asset Classes

Third Quarter 2017 Index Returns (%)

With broad market indices used as proxies, emerging markets outperformed developed markets, including the US, during the quarter.

The value effect was positive in non-US developed markets but negative in the US and emerging markets. Small caps outperformed large caps in US and non-US developed markets but underperformed in emerging markets.

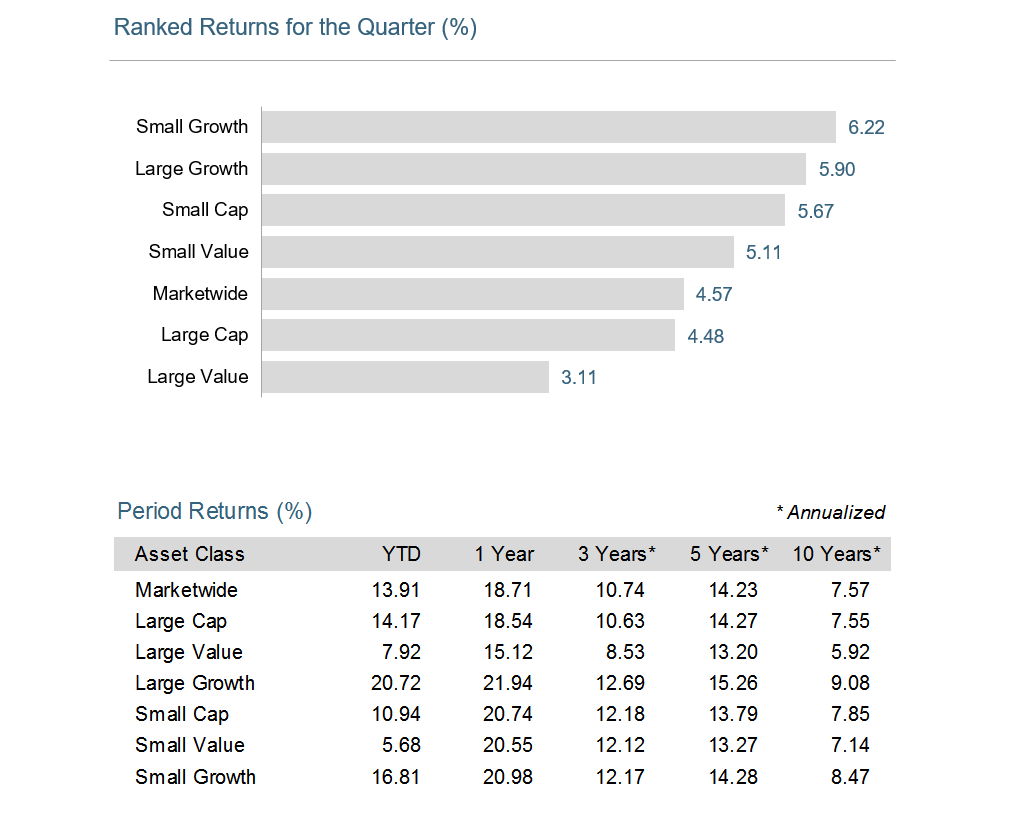

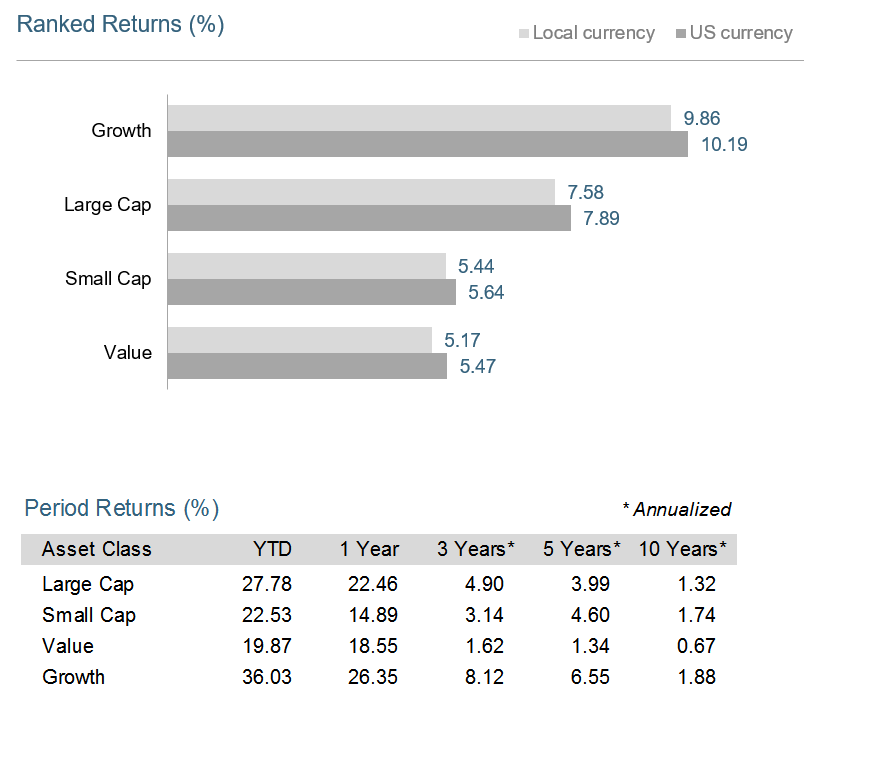

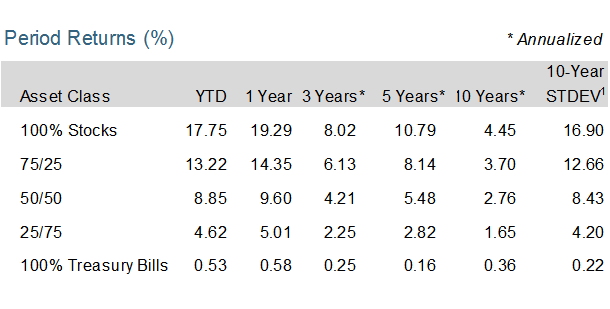

US Stocks

Third Quarter 2017 Index Returns

The broad US equity market posted positive returns for the quarter but underperformed both non-US developed and emerging markets.

Value underperformed growth indices in the US across all size ranges.

Small caps in the US outperformed large caps.

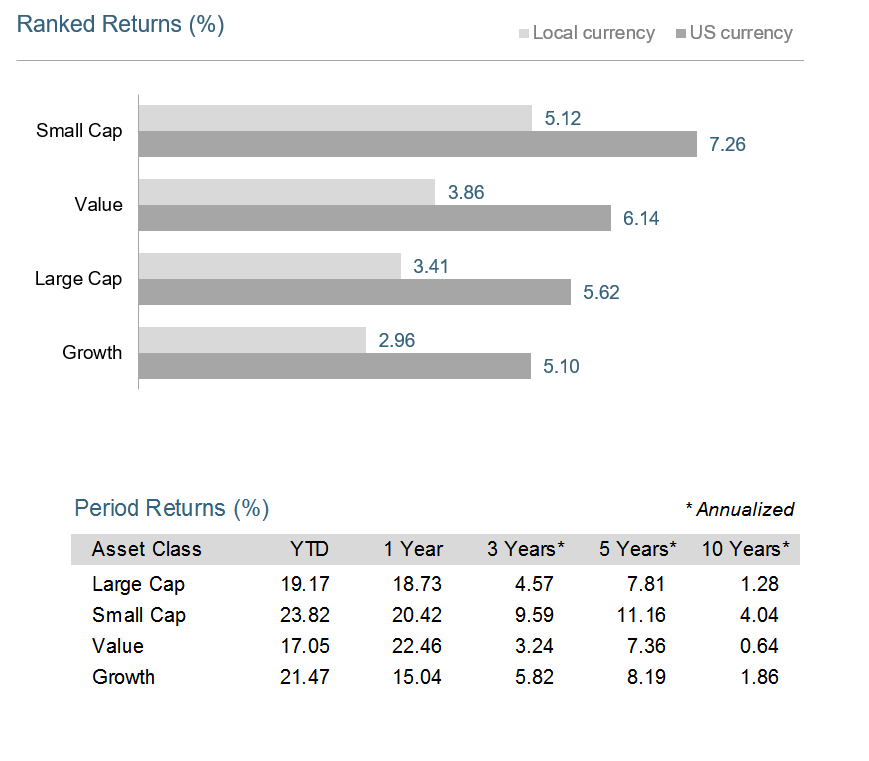

International Developed Stocks

Third Quarter 2017 Index Returns

Third Quarter 2017 Index Returns

In US dollar terms, developed markets outperformed US equity indices but underperformed emerging markets indices during the quarter.

With broad market indices used as proxies, the value effect was positive. The value effect was positive in large caps but negative in mid and small caps.

Overall, small caps outperformed large caps in non-US developed markets.

Emerging Markets Stocks

Third Quarter 2017 Index Returns

Third Quarter 2017 Index Returns

In US dollar terms, emerging markets indices outperformed developed market indices, including the US, during the quarter.

With broad market indices used as proxies, the value effect was negative. Across the size spectrum in the large and mid cap space, the value effect was negative; however, in the small cap space, the effect was positive.

Overall, small caps underperformed large caps in emerging markets.

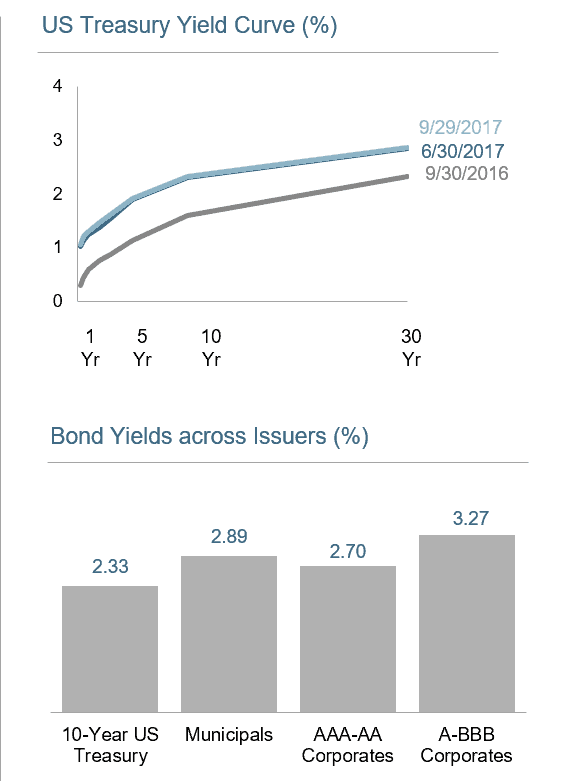

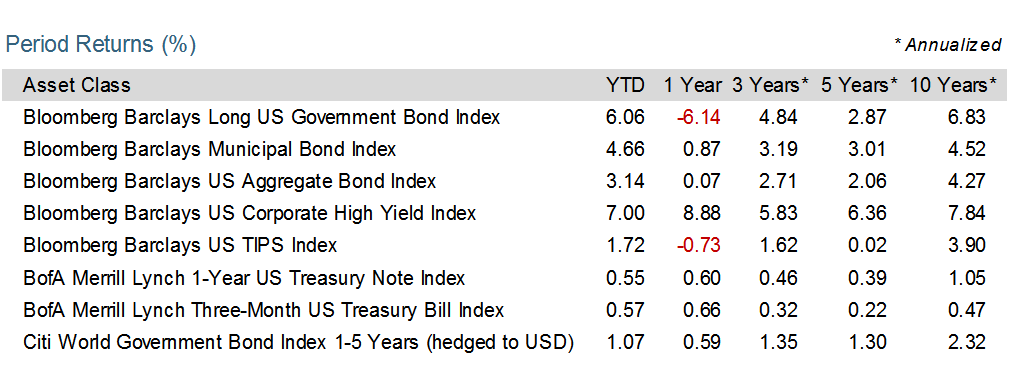

Fixed Income

Third Quarter 2017 Index Return

Third Quarter 2017 Index Return

Interest rates increased across the US fixed income market for the quarter. The yield on the 5-year Treasury note increased by 3 basis points (bps) to 1.92%. The yield on the 10-year Treasury note increased by 2 bps to 2.33%. The 30-year Treasury bond yield increased by 2 bps to finish at 2.86%.

The yield on the 1-year T-bill rose 7 bps to 1.31%, and the 2-year Treasury note yield rose 9 bps to 1.47%. The yield on the 3-month Treasury bill increased 3 bps to 1.06%, while the 6-month Treasury bill yield increased 6 bps to 1.20%.

In terms of total returns, short-term corporate bonds gained 0.59%, and intermediate-term corporates gained 1.05%.

Short-term municipal bonds generated a total return of 0.49%, while intermediate-term municipal bonds returned 0.83%. General obligation bonds gained 1.14%, outperforming revenue bonds by 4 bps.

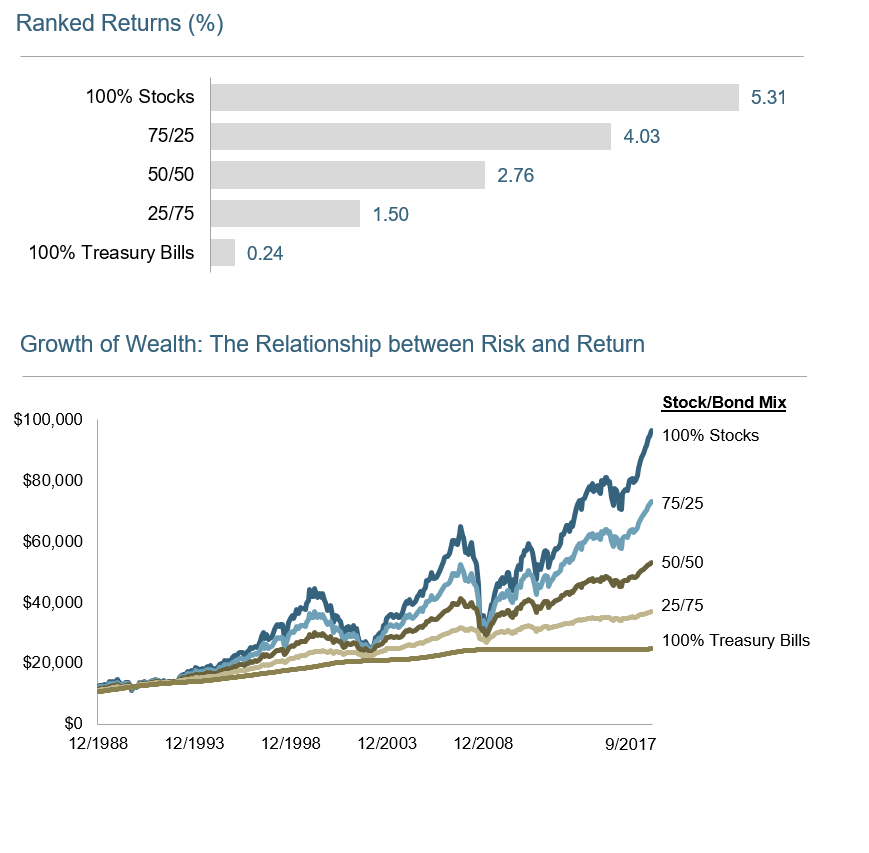

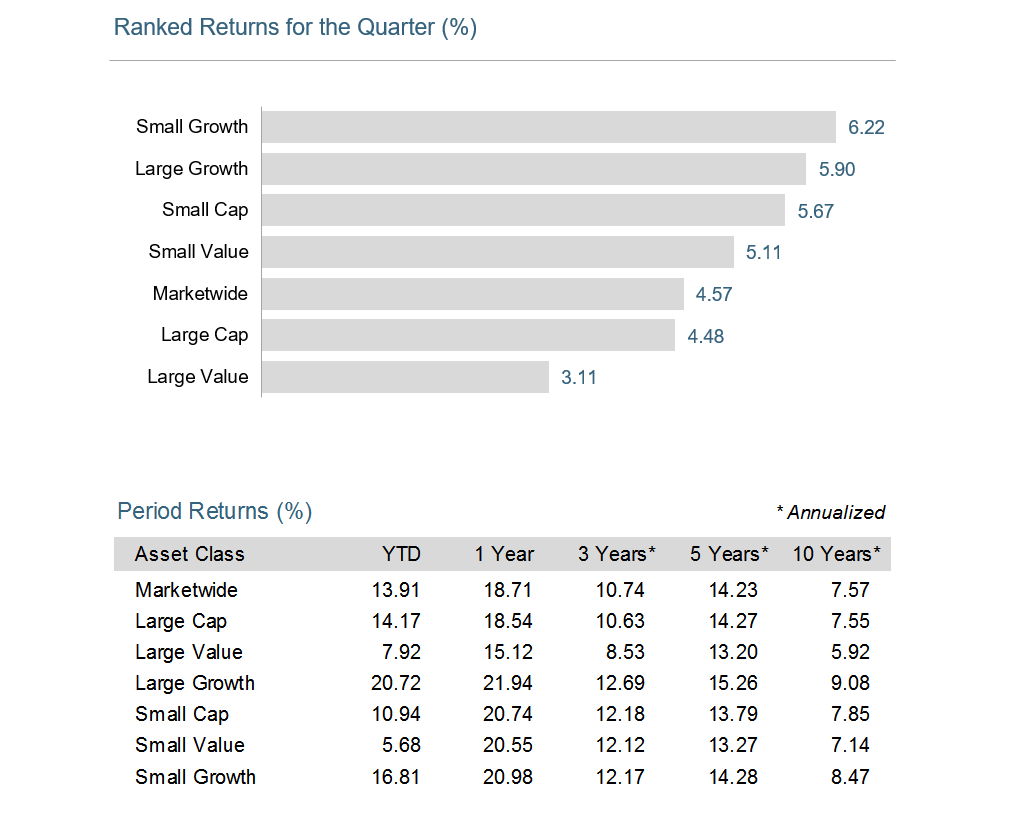

Impact of Diversification

Third Quarter 2017 Index Return

Third Quarter 2017 Index Return

These portfolios illustrate the performance of different global stock/bond mixes. Mixes with larger allocations to stocks are considered riskier but have higher expected

returns over time.

1. In US dollars MSCI developed markets country indices (net dividends). MSCI data © MSCI 2017, all rights reserved.

2. In US Dollars. US Small Cap is the Russell 2000 Index. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related ot the Russell Indexes. International Small Cap is the MSCI World ex USA Small Cap Index (gross dividends). MSCI data copyright MSCI 2017, all rights reserved.

Adapted from “Investment Shock Absorbers,” Outside the Flags, February 2017. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, soliciation, recommendation, or endorsement of any particular security, products, or services. Performance does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results.

Quarterly Market Review – Q3 2017

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The report also illustrates the impact of globally diversified portfolios.

Market Summary

Index Returns

World Stock Market Performance

MSCI All Country World Index with selected headlines from Q3 2017

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.

Graph Source: MSCI ACWI Index [net div.]. MSCI data © MSCI 2017, all rights reserved. It is not possible to invest directly in an index. Performance does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results.

World Stock Market Performance

MSCI All Country World Index with selected headlines from past 12 months

World Asset Classes

Third Quarter 2017 Index Returns (%)

With broad market indices used as proxies, emerging markets outperformed developed markets, including the US, during the quarter.

The value effect was positive in non-US developed markets but negative in the US and emerging markets. Small caps outperformed large caps in US and non-US developed markets but underperformed in emerging markets.

US Stocks

Third Quarter 2017 Index Returns

The broad US equity market posted positive returns for the quarter but underperformed both non-US developed and emerging markets.

Value underperformed growth indices in the US across all size ranges.

Small caps in the US outperformed large caps.

International Developed Stocks

In US dollar terms, developed markets outperformed US equity indices but underperformed emerging markets indices during the quarter.

With broad market indices used as proxies, the value effect was positive. The value effect was positive in large caps but negative in mid and small caps.

Overall, small caps outperformed large caps in non-US developed markets.

Emerging Markets Stocks

In US dollar terms, emerging markets indices outperformed developed market indices, including the US, during the quarter.

With broad market indices used as proxies, the value effect was negative. Across the size spectrum in the large and mid cap space, the value effect was negative; however, in the small cap space, the effect was positive.

Overall, small caps underperformed large caps in emerging markets.

Fixed Income

Interest rates increased across the US fixed income market for the quarter. The yield on the 5-year Treasury note increased by 3 basis points (bps) to 1.92%. The yield on the 10-year Treasury note increased by 2 bps to 2.33%. The 30-year Treasury bond yield increased by 2 bps to finish at 2.86%.

The yield on the 1-year T-bill rose 7 bps to 1.31%, and the 2-year Treasury note yield rose 9 bps to 1.47%. The yield on the 3-month Treasury bill increased 3 bps to 1.06%, while the 6-month Treasury bill yield increased 6 bps to 1.20%.

In terms of total returns, short-term corporate bonds gained 0.59%, and intermediate-term corporates gained 1.05%.

Short-term municipal bonds generated a total return of 0.49%, while intermediate-term municipal bonds returned 0.83%. General obligation bonds gained 1.14%, outperforming revenue bonds by 4 bps.

Impact of Diversification

These portfolios illustrate the performance of different global stock/bond mixes. Mixes with larger allocations to stocks are considered riskier but have higher expected

returns over time.

1. In US dollars MSCI developed markets country indices (net dividends). MSCI data © MSCI 2017, all rights reserved.

2. In US Dollars. US Small Cap is the Russell 2000 Index. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related ot the Russell Indexes. International Small Cap is the MSCI World ex USA Small Cap Index (gross dividends). MSCI data copyright MSCI 2017, all rights reserved.

Adapted from “Investment Shock Absorbers,” Outside the Flags, February 2017. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, soliciation, recommendation, or endorsement of any particular security, products, or services. Performance does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results.

Categories

Categories

Read Our Latest Articles Here

The Road Ahead: Financial Markets, Volatility, and Your Portfolio

When Retirement Arrives Suddenly: How to Cope when It’s “Too Soon”

Divorce and Social Security: Making the Right Calls