The famed pitcher Satchel Paige is often quoted as saying, “Don’t look back; something might be gaining on you.” Though Paige’s “proverb” might easily be viewed in a humorous light, it may actually be good advice for investors in the current market climate.

Of course, the dominant story in the markets, especially since the dramatic trade policy shift announced on April 2, has been great uncertainty around tariffs, the possibility of a worldwide trade war, and the implications for the US economy and businesses. When the markets face uncertainty, volatility is the typical result, and the current situation is a prime example. Market volatility—the volume and speed with which prices change—as measured by the VIX index remains at levels not seen since the onset of the COVID pandemic. Each news cycle brings fresh hints and speculations about developments in the tariff negotiations, and with each breaking news story, markets may swing wildly up or down—sometimes both on the same day.

But one way of looking at market volatility is as a sign that markets are functioning properly. The essential task of an efficient market is to price in the implications of various factors that can have a bearing on the value of the assets being traded. Each time a buyer and a seller agree on a price—a process that happens millions of times daily, around the world—both parties are conducting the transaction based on all the known information affecting the price of the asset. In this way, the financial markets are constantly looking forward, anticipating the effect on value of the ongoing chain of events in the world economy.

Without doubt, sudden drops in the market and heightened volatility can be unnerving, as can rapidly changing economic policies. But the market’s job is to process uncertainty in real time. When trade policies change swiftly, markets are incorporating a vast amount of information and expectations about how these shifts may shape the global economy. Markets do this on a forward-looking basis, continuously incorporating new information and setting prices so that expected returns are positive.

Economic policies, such as those related to tariffs and international trade, have financial impacts across the economy beyond market returns. The economic implications that markets almost instantaneously price into securities play out over a longer period in the real economy. This difference in velocity between market pricing and economic performance is important to understand, because it points to a difference in how we experience potentially negative (or positive) economic developments as investors versus as participants in the real economy. In other words, even if you are worried about ongoing economic challenges, you shouldn’t necessarily expect a negative investment experience going forward, because markets have already factored in known information.

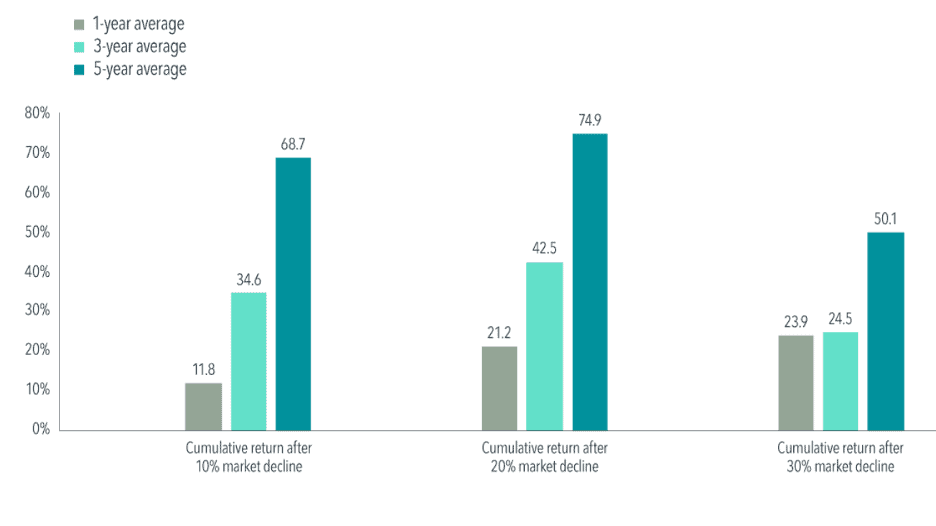

In fact, this “forward-looking” aspect of financial markets helps to explain why it is often the case that large market drops can be followed by major gains. As the following chart indicates, following downturns of 10, 20, or even 30%, US equities have generated positive cumulative returns, on average, during the following one-, three-, and five-year periods.

SOURCE: Dimensional Fund Advisors. Past results are no guarantee of future returns; indexes are not available for direct investment.

What may be most significant about these results, in fact, is that the largest gains have been seen during the five-year period following the downturns. This may underscore the importance of taking a longer view in the face of current volatility. In other words, when experiencing heightened volatility, the best course for many investors may be to remain invested and—like the markets—look forward to better times ahead.

At The Planning Center, we understand that the rapidly changing market landscape can be confusing and intimidating. We work with clients to build portfolios that are designed to ride out the waves of volatility that are an inevitable part of investing in the financial markets. Remaining committed to a long-term strategy and maintaining faith in the resilience of the markets can often help investors reach their important financial goals. We can assist by providing evidence-based counsel that can work to ease investors’ concerns about short-term market movements.

For more information, why not tune in to our recent webinar, “Navigating Turbulent Markets”? In this informative presentation, Senior Advisor H. Jude Boudreaux, CFP®, is joined by Apollo D. Lupescu, PhD, Vice President at Dimensional Fund Advisors. Dr. Lupescu offers insights into the current state of the markets and shares strategies for navigating today’s turbulent financial environment.