OBBBA and Your 529 Education Savings Plan

Many parents and grandparents have already discovered the tax advantages and other benefits of 529 education savings plans. But with the passage of OBBBA, 529 plans have acquired some new enhancements that can make them even better tools for many families.

Income Property: A Good Plan for Retirement?

Owning income-producing property can seem like a smart way to generate retirement income—but it’s not for everyone. In this article, Andrew Sievertson, CFP®, EA, CeFT®, explores when real estate makes sense as part of your retirement strategy, the pros and cons of being a landlord, and alternatives like 1031 exchanges, DSTs, or UPREITs for those seeking a more hands-off approach.

When Retirement Arrives Suddenly: How to Cope when It’s “Too Soon”

Even as far back as the pre-COVID-19 days, more than half of retired persons said they left the workforce earlier than planned, due either to unanticipated job loss or medical reasons.

Being Grateful Isn’t Just Good for Your Outlook: It’s a Good Retirement Strategy

There is research demonstrating that people who are habitually grateful for what they have also tend to be financially healthier. And that can make a big difference in the quality and satisfaction you achieve during your retirement years.

Smart Tips for Charitable Giving

A recent survey indicates that many donors still have questions about how they can make their giving more effective. In fact, two-thirds of those surveyed said that while they’d like to give more, they are concerned by factors that make it more difficult for them to give as much as they’d really like to.

What’s the Best Retirement Account for You?

In this brief article, we’ll take a quick survey of the major types of retirement savings vehicles to provide basic familiarity, then we’ll point out the advantages of certain types for various circumstances.

TPC Client Update Re: Swapping Mutual Funds to ETFs

by Andrew Sivertsen, CFP®, EA, CeFT® and Andy Baxley, CFP®, CIMA® The Planning Center’s Investment Committee

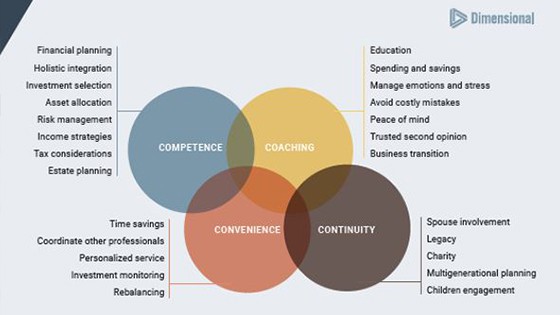

Why Do I Need a Financial Life Planner?

Andrew Sivertsen, CFP®, EA, CeFT®, Sr Financial Planner Concerns about money haven’t always been so

Understanding TPC’s Fiduciary Investment Strategies

by Andrew Sivertsen, CFP® CeFT® At The Planning Center (TPC) our investment strategy primarily uses

The History of ETFs and their Rise of Popularity

by Andrew Sivertsen, CFP® CeFT® Exchange Traded Funds (ETFs) were developed in the late 90s

To Spend or Not to Spend

by Andrew Sivertsen, CFP® CeFT® To spend or not to spend, that is the question?

The Grass Is Still Growing

by Andrew Sivertsen, CFP® CeFT® Six months ago, I wrote an article about how to