At TPC, we believe effective retirement planning has never been more important. Retirees today are asked to contend with a greater number of variables and high stakes decisions than any generation in the past. It’s not surprising that many people find the process to be more than a little overwhelming! While planning for retirement does inevitably have a lot of moving parts, it doesn’t have to be stressful. Believe it or not, we’ve found that it can actually be a lot of fun!

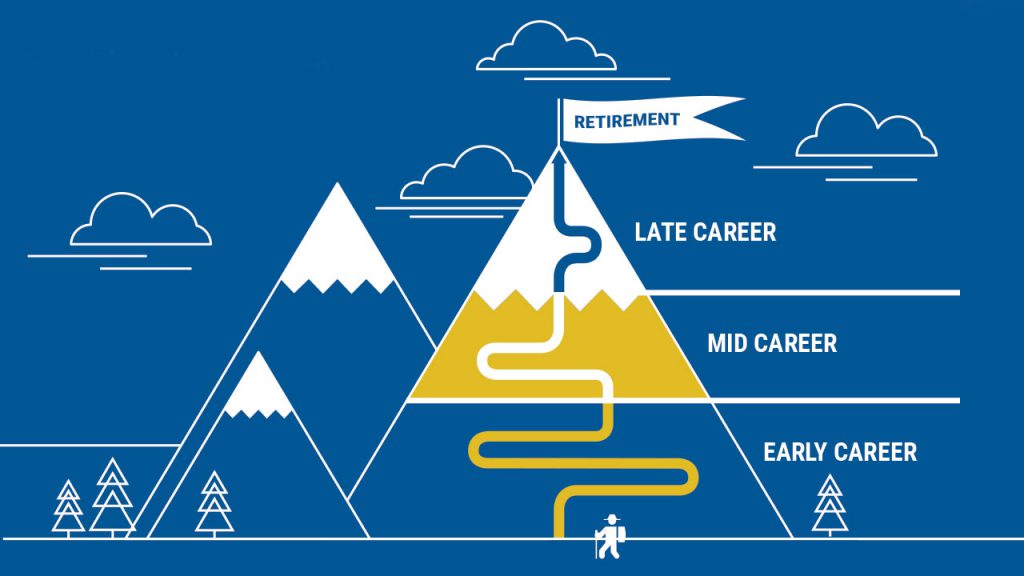

The “Expedition to Retirement” webinar series brings together a diverse array of expert speakers to help simplify and clarify the journey to retirement. Our hope is that this series leaves you feeling more confident, secure, and inspired as you plan your own path towards this all-important milestone.

We invite you to learn more about each webinar and signup to attend below. Any questions or comments are always welcome and can be sent to info@theplanningcenter.com. We look forward to being your guide on this 8 part webinar series expedition!

Expedition to Retirement Webinars:

Webinar Date/Time: April 15, 2021 11am-12pm CT

Presenter(s):

Andy Baxley, CFP®, CIMA®

Andy Baxley is a Sr. Financial Planner with The Planning Center’s Chicago office. Andy joined the firm in 2020 after serving as a Wealth Management Advisor with TIAA. He is a Certified Financial Planner® practitioner, a Certified Investment Management Analyst®, and a graduate of Kansas State University’s master’s in financial planning (MSFP) program, with concentrations in advanced financial planning and financial therapy. As a former educator, Andy takes pride in his ability to explain complex financial planning topics in ways that are simple and easy to understand.

Presentation Description:

Retirement is one of the most fundamentally life-changing transitions many of us will ever experience. It is an opportunity to redesign one’s lifestyle, spend time with those who are most important, and focus on the goals that work never seemed to leave time for. Research tells us that retirement has the potential to one of the most fulfilling chapters of our lives, but careful planning is essential if we are to make the most of these years. Join Sr. Financial Planner, Andy Baxley, as he explores what research and experience tell us about the habits, practices, and mindsets unique to those who thrive in retirement.

What we’ll cover:

• Defining “success” in retirement

• The surprising research on well-being in retirement

• The history of modern retirement

• The importance of staying engaged and active

• Why flexibility is a financial planning superpower

• Exercises for establishing purpose and meaning in retirement

Sorry you missed this webinar on April 15th. To watch a recording, please click below

Webinar Date/Time: May 3, 2021 11am-12pm CT

Presenter(s):

Since 1982, Dr. Marty Martin has given over 2,500 presentations all over the world to clients in the fields of health care, financial planning, and higher education. In his work with The Planning Center, Marty’s focus is on applying the science of psychology to financial planning, retirement planning, and career planning. His scholarly and consulting work has been featured in stories appearing in the Wall Street Journal, Washington Post, and USA Today. He has also written two books: The Inner World of Money: Taking Control of Your Financial Behavior, published by Praeger Press in 2012 and Taming Disruptive Behavior, published by The American College of Physician Executives (ACPE) in 2013.

Presentation Description:

Pre-retirees often spend countless hours thinking through the financial complexities of retirement, yet few take time to consider the emotional and social implications of this all-important life transition. In reality, retirement represents one of the most dramatic lifestyle shifts most people will ever experience. This change can be unsettling for some, but it also represents an opportunity for reinvention and creativity. Join speaker, author, and psychologist, Dr. Marty Martin, as he explores the joys and challenges that arise when working life ends and retirement begins.

What we’ll cover:

• How the retirement experience tends to change over the years

• The importance of experimentation and regeneration

• The surprising challenge of filling your schedule in retirement

• Coping with loss of identity and purpose after leaving work

• Navigating retirement as a couple; developing a shared vision

• Establishing healthy boundaries with children and grandchildren

Sorry you missed this webinar on May 3rd. To watch a recording, please click below

Webinar Date/Time: May 27, 2021 11am-12pm CT

Presenter(s):

Michael Branham is a Sr. Financial Planner with The Planning Center’s Anchorage office, as well a former President of The Financial Planning Association, the industry’s leading professional network. Michael joined The Planning Center in 2015 after serving as a financial planner with Cornerstone Wealth Advisors for 12 years. As a Certified Financial Planner® practitioner with over 20 years of experience, Michael specializes in working with clients to develop sustainable and strategic retirement income plans. In addition to his work with clients, Michael serves on The Planning Center’s Investment Committee, helping to guide key investment management decisions for the firm’s managed portfolios.

Presentation Description:

“How much can I afford to spend in retirement?” Nobel Prize-winning economist William Sharpe called this deceptively simple question “the nastiest, hardest problem in finance”, and for good reason. Solving for one’s retirement income needs is a puzzle with many pieces and a great deal of uncertainty. Join Sr. Financial Planner, Michael Branham, as he examines the latest research and best thinking around retirement income planning.

What we’ll cover:

• Coordinating various retirement income sources

• How to maximize your Social Security benefit

• Determining a safe portfolio withdrawal rate

• Planning for unexpected expenses

• Tax-efficient withdrawal strategies

• Strategic charitable giving and family gifting

• The power of flexible spending plans

Sorry you missed this webinar on May 27th. To watch a recording, please click below

Webinar Date/Time: June 23, 2021 11am-12pm CT

Presenter(s):

Shay Hata and Chad Lubben

Shay Hata is an Ivy League grad, mom, and residential Realtor in Chicago, IL with Berkshire Hathaway. She helps over 100 families a year buy or sell homes and takes pride in treating all her clients like VIPs. She is known for outstanding customer service, fast response times, and incredible negotiation skills, having attended Harvard's Negotiation Institute. Shay believes strongly that it is not only her duty to represent her clients to the best of her ability, but also to educate them throughout the process so they can make the best short- and long-term decisions possible. Shay donates a portion of each commission to local animal rescue groups as well as local schools, believing strongly that a good education should be available to every child, as it was to her as the daughter of a working-class single mom. For more information on Shay visit www.buyselllovechicago.com.

As a Senior Loan Consultant with Summit Funding, Chad Lubben has consistently been recognized by industry publications as one of the top loan originators in the country. Chad’s well-rounded and insightful approach to mortgage lending is rooted in an ethos of exceptional service and client education. Chad is a nationally recognized public speaker with expertise in condo lending, mortgage bond trading, and jumbo lending. Prior to joining Summit funding, Chad was an owner/operator for Great Lakes Loan Centers and a Leader’s Club producing Loan Officer for Wells Fargo. Outside of work, Chad is a proud father and supporter of the March of Dimes, a US-based non-profit that works to improve health outcomes of mothers and their babies.

Presentation Description:

For many, retirement presents an opportunity for lifestyle redesign. No longer tied to the city or town of their employer, retirees are free to think creatively about how, and where, they want to live. Downsizing, moving to a different state, and purchasing a second home are just a few of the real estate transitions most common to today’s retirees. Join real estate experts Shay Hata and Chad Lubben as they share what you need to know to plan effectively for your own changing real estate needs.

What we’ll cover:

• The art of downsizing; picking a home you’ll love for years to come

• Exploring Continuing Care Retirement Communities (CCRCs) and other alternative living arrangements

• Planning and preparing for property taxes

• How to maximize your home’s resale value

• The snowbird retirement strategy; owning property in more than one state

• Qualifying for a mortgage when you no longer have earned income

• Avoiding common mistakes in the loan origination process

Sorry you missed this webinar on June 23rd. To watch a recording, please click below

Webinar Date/Time: July 22, 2021 11am-12pm CT

Presenter(s):

Matt Knoll, CFP® and Amber Miller, CFP®, CSRIC®

Matt Knoll’s role as a Sr. Financial Planner with The Planning Center’s Quad Cities office allows him to help people make progress every day toward improving their financial picture. When he’s not meeting with clients, he runs the daily trade desk activity and helps with operation workflows. Matt started working at The Planning Center as an intern in the summers of 2011 and 2012 and joined the firm full-time after graduating from Iowa State University with a degree in finance in 2013. He cherishes building relationships with clients by helping them achieve some of their most important financial goals.

Amber Miller helps responsible women and young professionals make smart decisions with their money so they can spend more time on their busy, adventurous lives and less on their financial worries. She specializes in working with pediatric healthcare professionals and superstar women in tech. She is currently one of less than 500 financial professionals to hold the Chartered SRI Counselor (CSRIC) designation, which specializes in sustainable, responsible, and impact investments (SRI). These are investments that consider the environment as well as incorporate procedures and governance to not only generate a return for a client but also to make a positive societal impact. Amber is a Sr Financial Planner at The Planning Center and currently leads the Minneapolis office.

Presentation Description:

The transition into retirement often requires a great leap of faith in financial markets. But what goes on inside our brains when we make decisions around investing? The stakes are high, making thoughtful investment decisions an essential component of any financial plan. Join Sr. Financial Planners Matt Knoll and Amber Miller as they explore the principals of behavioral finance and the systems and strategies that today’s pre-retirees and retirees should consider when building and monitoring their portfolios. And be sure to stay tuned to the end to learn how investors can align their portfolios not only with their risk tolerance and income needs, but also with their most deeply held values.

What we’ll cover:

• Our natural tendencies around investing

• How behavioral biases can sabotage a sound investment strategy

• The importance of having an investment management process

• Managing the risks of investing in retirement

• Asset allocation, diversification, and how to build and monitor a portfolio

• Socially Responsible Investing 101; the basics of values-based investing

Sorry you missed this webinar on July 22nd. To watch a recording, please click below

Webinar Date/Time: August 26, 2021 11am-12pm CT

Presenter(s):

Ben Neiburger, JD, CPA

As one of only a few elder law attorneys in Illinois with a CPA after his name, Ben Neiburger offers a unique perspective to help his clients plan for their future. Since founding his firm, Generation Law, in 2003, Ben has helped thousands of families care for aging loved ones, resolve family conflicts, afford long-term care costs, and ensure their wishes are carried out – without losing their sanity or going broke. Ben formed Generation Law, which concentrates in elder law, estate planning, wills and trusts, and guardianship and probate litigation, after spending several years with worldwide law firm Baker & McKenzie. Ben was named an Illinois Super Lawyer in Elder Law in 2007, receiving this recognition again in 2009 and every year since. After graduating with a degree in finance from the University of Illinois, Champaign-Urbana, he earned his law degree from IIT Chicago-Kent College of Law

Presentation Description:

Estate planning is the art of asking and answering some of life’s most sensitive and important questions. Who will make decisions on my behalf if I am unable? What are my wishes for end-of-life care, and how can I ensure they are carried out? How can I avoid creating a financial burden for my children? How can I leave a meaningful legacy for the next generation? Join estate and elder law attorney, Ben Neiburger, as he draws from over two decades of experience to address some of the most critical estate planning considerations facing today’s retirees.

What we’ll cover:

• Essential estate planning documents

• Common estate planning mistakes to avoid

• The difference between a will and a trust

• The importance of adapting your estate plan to legislative changes

• Gifting to family and charity

• Maximizing the value of the assets you pass to heirs

• How to plan for diminished capacity

• Covering long term care needs

Sorry you missed this webinar on August 26th. To watch a recording, please click below

Webinar Date/Time: September 16, 2021 11am-12pm CT

Presenter(s):

Dianne Savastano is the Founder and Principal of Healthassist, a Massachusetts-based company founded in 2004 that specializes in helping clients navigate the complexities of the healthcare system. Beginning as a registered nurse providing direct patient care, Dianne’s 30-year career includes roles as a hospital, insurance, and employee benefits executive and as a management consultant. Her experience has taught her to ensure that the healthcare consumer is at the center of the healthcare equation. A frequent, sought-after speaker, Dianne has delivered programs covering a wide range of critical healthcare-related topics covering patient advocacy, Medicare choices, healthcare reform and more.

Presentation Description:

As individuals approach the age of 65 and become eligible for Medicare, they are often confused about when to enroll and in addition, surprised and overwhelmed by the choices available to them. Options are plentiful and understanding the differences between Parts A, B, C, and D, and what each option covers, is important. There are many nuances to the timing of enrollment and if you are unaware of these different windows of opportunity, and miss them, you could find yourself uninsured for a period of time and paying monetary penalties. Join Dianne Savastano, founder of Healthassist, as she discusses the key factors every retiree needs to keep in mind as they plan for a successful transition to Medicare coverage.

What we’ll cover:

• Medicare costs

• What traditional Medicare does and does not cover

• The differences between Medicare Part A, B, C, D, and Medicare Supplement (Medigap) Plans

• How open enrollment works

• What is a donut hole, anyway?

Sorry you missed this webinar on September 16th. To watch a recording, please click below

Webinar Date/Time: October 28, 2021 11am-12pm CT

Presenter(s):

Caleb Arringdale brings over 11 years of public accounting expertise to his role as a Tax Advisor with The Planning Center’s Quad Cities office. Caleb’s career began at a CPA firm in Bettendorf, IA, where he specialized in small business and not-for-profit accounting and taxation. After several years with that firm, Caleb accepted a position as Controller of a mid-size restaurant chain with locations throughout the US. Prior to joining The Planning Center, he spent several years with a small accounting firm in Galesburg, IL, helping clients with a wide range of financial and tax issues.

Presentation Description:

Effective tax planning is a moving target. Not only does each person’s tax situation change year-over-year, the legislative environment is constantly in flux as well. The complexities of the tax code can be overwhelming, but careful tax planning is a key component of any successful retirement plan. Join Caleb Arringdale, Tax Advisor at The Planning Center, as he simplifies some of the most important tax-related issues facing today’s retirees.

What we’ll cover:

• How Social Security is taxed

• Strategies for minimizing your lifetime tax bill, and that of your heirs

• Roth conversions and harnessing the power of “gap years”

• The impact of state residency on taxes

• Tax-efficient portfolio withdrawal strategies

• Tax-efficient charitable giving

Sorry you missed this webinar on October 28th. To watch a recording, please click below