What We Do

“We uncomplicate the complicated.” – Marty Kurtz, Founder, CFP®

More About TPC

The Planning Center is a fee-only financial planning firm that provides a safe place for you to discuss what matters most to you and your family with a team of credentialed financial advisors.

We believe that all financial decisions are emotional decisions, and in order to make more effective decisions, everyone could use an objective third party to talk about life and money.

Our goal is to help you make better decisions as you navigate life’s transitions and guide you toward the life you would like to have.

Over time, your needs will evolve. The transitions you experience in life–marriage and family, wealth accumulation, your career–require an evolving perspective on priorities, strategies, and goals. We incorporate this growth into your plan. We can analyze your situation and help manage your financial options to keep you organized and on course. Whatever stage of life you are in, we have the tools and knowledge to support you every step of the way.

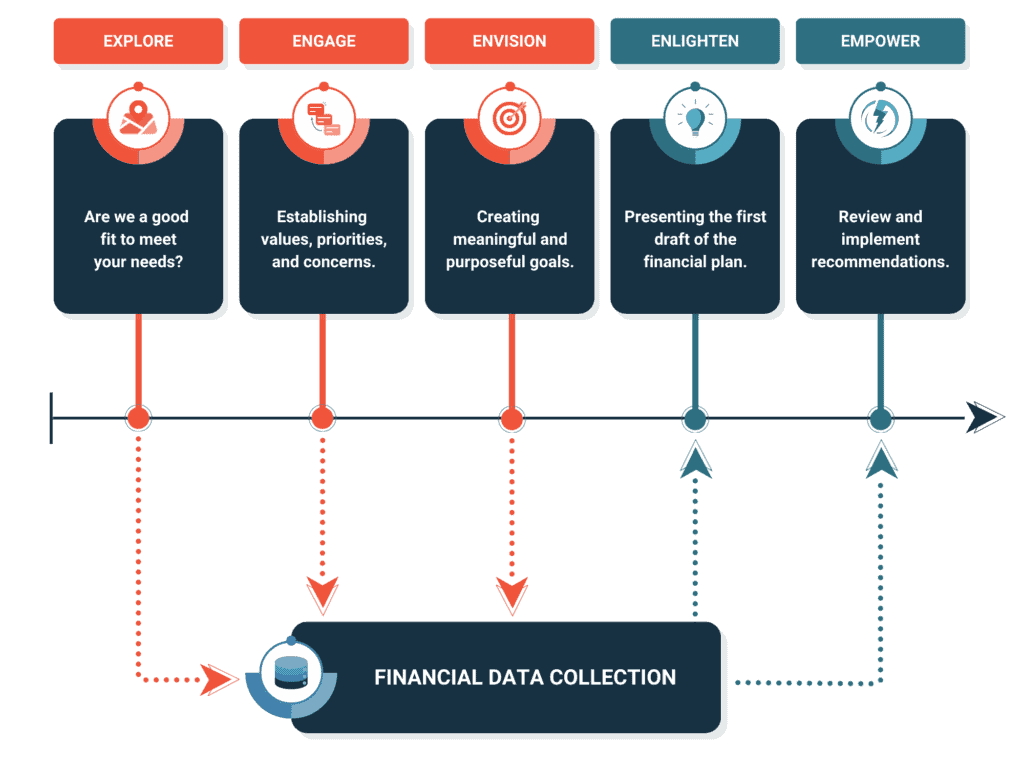

What to Expect

Independent, Fee-Only Fiduciary Model

All of our financial planners adhere to an independent, fee-only, and fiduciary approach, allowing us to offer unbiased advice and a wide range of financial solutions tailored to your situation and goals.

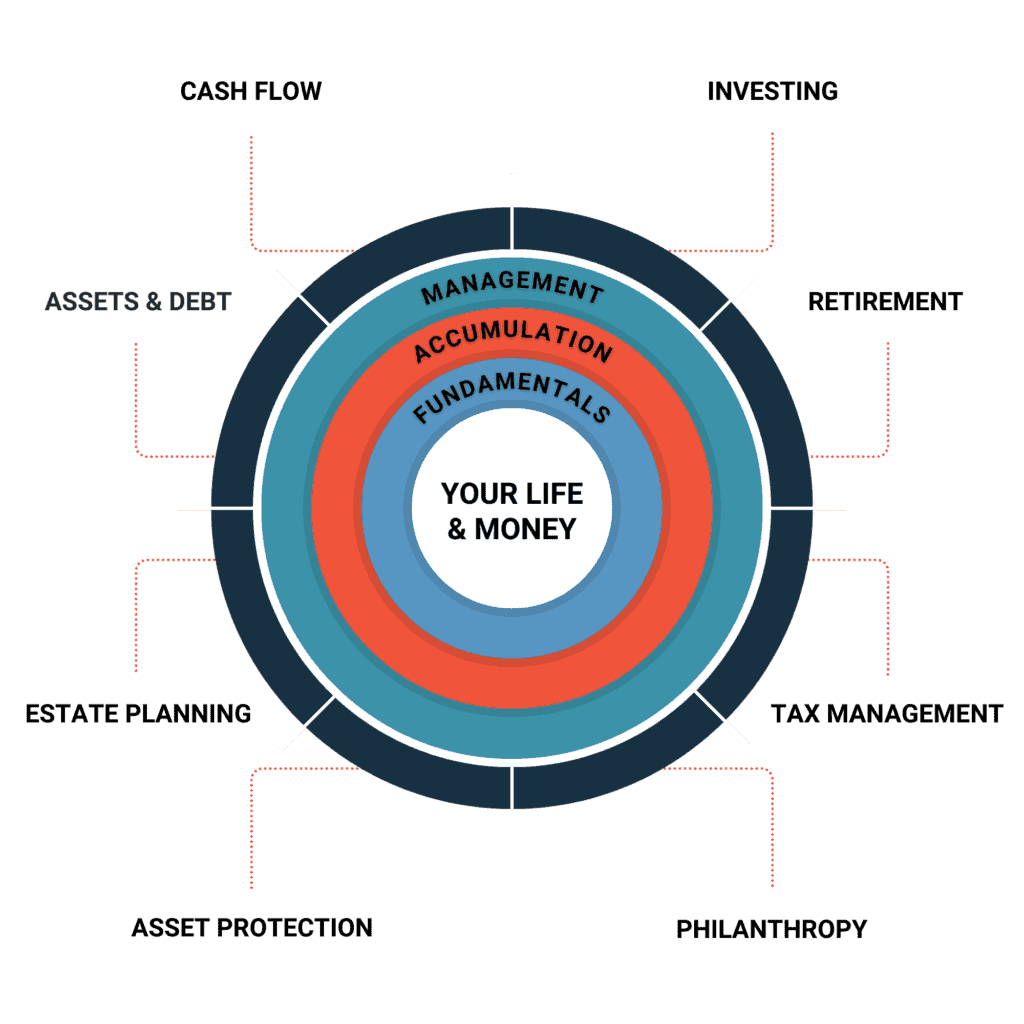

Build Confidence In Your Financial Future

We believe that your wealth and life should be in balance. No matter what stage of life you are in, you are impacted by these eight financial categories. We will work with you to address issues and identify opportunities to track and grow your progress toward better wealth life balance.

Asset & Debt Management

In order to make a plan for the future, it helps to begin with a clear understanding of where you are today. In this assessment process, some of the areas we evaluate together include:

Establish & Track Net Worth

Your net worth is defined as the assets you own minus any debts you owe. We will track this number continuously and use it as a barometer to measure your progress. The goal is to grow your net worth over time through a combination of savings, debt reduction, and prudent investing.

Review Cash Reserves & Liquidity

Cash reserves are needed to prepare for unexpected bumps in the road. We will help determine how much liquidity you need and where it should be kept.

Assess Credit & Explore Possibilities

Some types of credit can be used for wealth creation, but others are destructive. We will help you determine how to utilize credit strategically and avoid common debt traps.

Planning for Business

Business planning begins with a review of your current entity structure, documents, and potential succession plans to anticipate any potential income or taxation complications. We will explore retirement plan options and help you choose the best one to meet your goals.

Cash Flow & Income Management

The journey to wealth begins with a single step, and that all-important first step is to establish a strategy for managing your cash flow. In this assessment process, some of the areas we evaluate together include:

Establish Current Income Streams

Your current income streams provide the fuel for wealth creation and preservation. We first seek to understand these income sources, then create a plan for sustaining or growing them over time.

Discuss Irregular Income & Expenses

Certain types of income, such as bonuses, commissions, and stock options, require special planning to account for their complexity and irregularity. Likewise, significant expenses that do not follow a predictable pattern can compromise your plan if not properly accounted for. We will keep your plan on track by anticipating and preparing for these varying sources of income and expense.

Implement First Step Cash Management™

We will train you to use a cash flow system that simplifies and clarifies your decision-making process. By categorizing expenses into past commitments, present choices, and future needs & wants, you will establish an automated system for meeting your saving and spending goals.

Optimize Banking Structure

With some simple concepts and structures, we can line up bank accounts with automatic transfers to meet your needs and goals. Sometimes special considerations will need to be made for business owners or individuals with irregular income to smooth out the flow of cash at the bank.

Investment Management

Your investment portfolio is the engine that powers the growth of your wealth over time. We believe investment success is achieved through the implementation of rigorous, research-based portfolio management strategies designed around the needs of each client.

In this assessment process, some of the areas we evaluate together include:

Determine Risk Preference

Your investment portfolio should be a reflection of your financial needs and your comfort level with risk, which we will determine using a psychometric risk assessment. We will use this data to construct a portfolio designed to meet your financial goals while managing risk responsibly.

Construct a Portfolio

We construct globally diversified, tax-efficient portfolios consisting of low-cost exchange-traded funds and mutual funds from well-established investment companies. Drawing on decades of research from Nobel Prize winners Eugene Fama and Kenneth French, among others, we implement evidence-based strategies that have withstood the test of time. Though periods of short-term volatility are to be expected, stocks have historically rewarded patient, long-term investors.

Align Portfolio to Goals

We will help you define and plan for your short, medium, and long-term goals. Once your risk profile and goals are integrated into your plan, simulations will be run to determine whether you’re on track and how increases or decreases in risk might affect your outcomes.

Rebalance Assets

Over time, market conditions may cause certain investments to become overweight or underweight relative to their intended allocations. We monitor these changes carefully and bring the portfolio back into balance any time a given investment deviates significantly from its target. This strategy, known as opportunistic rebalancing, allows us to take advantage of volatility by capturing gains on assets that have increased in value and reallocating them to assets with more favorable pricing.

Monitor Market Pricing

In addition to monitoring and rebalancing each individual investment within the portfolios we manage, we keep a watchful eye on global market valuations. Using predetermined thresholds and well-established valuation measures, we reduce stock exposure incrementally when the market “overheats” and increase it when market pricing is more favorable for long-term returns. As with opportunistic rebalancing, this strategy is designed to reduce risk and portfolio volatility over time.

Adjust Allocation

We will schedule a regular review cycle to check in on your goals, objectives, and resources as they change over time. Updating the plan projections will help us to determine whether there is a need to adjust the portfolio allocation.

Insurance & Benefits Review

No matter how carefully you plan for the future, unexpected circumstances are often unavoidable. Fortunately, these challenges do not have to derail your carefully laid plans. A careful review of your insurance and benefits portfolio is the first step to helping you and your family stay protected and prepared to weather any storm.

In this assessment process, some of the areas we evaluate together include:

Life Insurance Needs Analysis

Your life insurance portfolio should be a reflection of your family’s unique needs. Effective planning in this area begins with one essential question- How would your loved ones be financially impacted if you were to pass away earlier than expected? Our process begins with a careful analysis to answer this question. From there, we create a plan to help protect your family’s financial security.

Protecting Your Income (Disability Insurance)

When it comes to becoming too sick or hurt to work, many people think, “It won’t happen to me.” We will help you assess the risks, review current coverages, and determine if there is need remaining.

Health Insurance Strategies

We want to help you understand your coverage options, whether it be through a personal plan, employer plan, Medicare, or the Marketplace. In certain cases, we can help you obtain significant tax savings through the proper use of HSAs and FSAs, as well as optimization of Premium Tax Credits when buying insurance from the Marketplace.

Minimizing Long-Term Care Risks

The cost of long-term care has increased in recent years and may continue to do so in years to come. Regardless of how well you’ve planned for your retirement living expenses, conducting a thoughtful assessment of your potential long-term care needs could be beneficial. With this knowledge, we can explore different ways to cover these costs should they arise.

Property & Casualty Coverage

We aim to help you achieve peace of mind regarding your asset protection. Our process involves helping you identify gaps in your insurance portfolio and refer you to a trusted professional to obtain the coverage you need at a reasonable price.

Personal & Professional Liability

We will discuss liability risk from a personal and professional perspective. After reviewing any current policies, we can recommend a plan for coverage.

Benefits Review

Many employers offer a wide array of supplemental benefits as a part of their employees’ “total compensation” packages. Taking full advantage of these valuable benefits is an essential component of a well-rounded financial plan. We will conduct a thorough review of your employee benefits package to make sure your elections are properly aligned with your situation and goals.

Estate Planning

The peace of mind that accompanies a well-crafted estate plan is one of the greatest gifts we can give our loved ones and ourselves. Planning for an organized estate not only helps to avoid probate and unnecessary taxes, it reduces stress and uncertainty for everyone involved.

In this assessment process, some of the areas we evaluate together include:

Establish & Review Documents

We will teach you the essentials of estate planning, demystifying often-misunderstood tools such as wills, trusts, powers of attorney, and buy-sell arrangements. We will work together with your attorney to create a strategy that aligns your estate plan with your wishes and the best interest of your family.

Review Beneficiary Designations

We will assist you in reviewing your retirement account and life insurance beneficiary designations to help make them both tax-efficient and aligned with any special provisions for dependent minors. As life progresses, we’ll review your beneficiaries to make sure they remain updated as your family tree grows and evolves.

Optimize Asset Titling

Appropriate asset titling can simplify estate settlement and save thousands of dollars in probate and tax costs. We will assess the titling of your various assets to help optimize your plan for simplicity and cost-efficiency. Where needed, we will help you retitle accounts in accordance with the plan we’ve established together with your attorney.

Other Estate Concerns

We’re here to help as other estate-related needs and concerns arise. Whether it’s establishing end of life wishes, coordinating and assigning roles to key individuals, or navigating the emotional challenges that naturally arise throughout the estate planning process, we’ll be with you every step of the way.

Family & Charitable Giving

Strategic giving is where your financial plan and your generosity intersect. We will work together to develop a gifting plan that is tax-efficient and built to make a lasting impact on the causes and organizations most important to you.

In this assessment process, some of the areas we evaluate together include:

Define Values & Goals

We will look at how you are allocating your time and money to various charitable efforts. Our hope is to help you prioritize what is going to make the biggest impact toward your goals.

Make a Giving Plan

We will outline which giving strategies are available to you and recommend a course of action that aligns with your intended goals. We will integrate these recommendations with your overall plan so all strategies are properly coordinated.

Optimize Tax Efficiency

From Donor-Advised Funds to Trusts, Family Foundations, and more, there are a number of underutilized tools that typically reduce tax liability far better than writing a check to a charity. We will help you explore ideas to make sure your gifts are tax-efficient.

Collaborate with Experts

Many charitable strategies involve third parties, such as foundations, trustees, attorneys, accountants, fundraisers and more. We will be there to collaboratively lead the team so that you don’t have to.

Retirement Planning

How do we balance the need to save for the future with a desire to live for today? In this assessment process, some of the areas we evaluate together include:

Set & Review Goals

We will work together to explore what is possible and craft a clear vision for the future, then set goals to make this vision a reality. Of course, setting goals is only the beginning. We provide the accountability and continued support to help you stay on track.

Track and Celebrate Progress

Building sustainable wealth isn’t easy, and it doesn’t happen overnight. It’s a stepwise journey that requires years of diligence and thoughtful planning. As with any adventure, it’s important to take a break and reflect on how far you’ve come. We will help you track your progress so you can celebrate every milestone along the way.

Run Financial Projections

We utilize advanced financial planning software that pulls together your expense needs, income sources, and assets to project a probability of success and inform our recommendations. By constantly updating the plan, we can determine when minor adjustments are needed to stay on track to meet your goals.

Commit to a Plan

We will be your thinking partner to brainstorm and strategize the best way to utilize financial instruments and tax efficient vehicles to achieve your goals. Together, we will prioritize your goals, then break them into measurable and attainable steps that can be tracked over time.

Tax Planning

In order to make a plan for the future, it helps to begin with a clear understanding of where you are today. In this assessment process, some of the areas we evaluate together include:

Establish & Track Net Worth

Your net worth is defined as the assets you own minus any debts you owe. We will track this number continuously and use it as a barometer to measure your progress. You will grow your net worth over time through a combination of savings, debt reduction, and prudent investing.

Review Cash Reserves & Liquidity

Cash reserves are needed to prepare for unexpected bumps in the road. We will help determine how much liquidity you need and where it should be kept.

Assess Credit & Explore Possibilities

Some types of credit can be used for wealth creation, but others are destructive. We will help you determine how to utilize credit strategically and avoid common debt traps.

Restricted Stock Units

Restricted Stock Units (RSUs) have become an increasingly common component of employee compensation packages, especially for executives and employees at public companies. In the form of deferred, stock-based compensation, an employer promises to issue shares of the company’s stock to you at a future date, typically subject to a vesting schedule. RSUs can be a powerful wealth-building opportunity with significant tax and financial planning considerations.

At The Planning Center, we help guide clients through the complexities of RSU compensation. We take an integrated approach to maximize the value of your RSU grants within the context of your overall financial situation and goals.

In the RSU assessment process, some of the areas we evaluate together include:

Understand Your RSU Grants

We will review the details of your outstanding RSU grants, including the vesting schedule, expiration dates, tax withholding rates, and any other unique provisions. This review forms the foundation for developing an informed strategy.

Analyze Concentration Risk

A concentrated equity position in your employer’s stock can expose you to undue risk. We model scenarios to assess your overall net worth exposure and determine if position management strategies like diversification are advisable as your grants vest.

Integrate With Financial Plan

RSUs can represent a meaningful portion of your total compensation package. We incorporate projected RSU income into your integrated financial plan to help it align with your defined financial goals, risk tolerance, and investment strategy.

Vesting and Tax Planning

Vested RSUs are considered taxable income in the year of vesting. Our in-house tax team conducts year-round tax projections to minimize your liability through strategies like maximizing retirement contributions, gift planning, and timing vesting strategically.

Cash Flow Planning

Many clients use RSU proceeds for larger purchases or to bolster cash reserves. We develop customized cash flow models to evaluate different what-if scenarios, helping you remain on track regardless of how you utilize your vested shares.

Optimal Timing and Strategies

Deciding when to sell your vested RSUs requires careful consideration of market conditions, financial needs, liquidity requirements, and tax implications. We aim to provide guidance on timing considerations and potential strategies.

Whether you are just beginning to receive RSU grants or have accumulated them for years, our team can help you develop a strategy that is integrated with your overall financial plan.

Schedule a consultation to learn how we can help you navigate this important aspect of your employment compensation, or view the video below to gain a better understanding of RSUs.

Let's Start a Conversation

Take the first step towards simplifying your financial decision-making. Complete the form below and our team will connect with you.

Send Us a Message

We’d like to meet you!

Schedule a free 15 minute conversation and we’ll spend a few minutes getting to know each other so we can learn if what you are seeking and what we provide are a good fit for each other. If it seems like a fit, we’ll talk about next steps. If we’re not, we’ll help you find the right group for your needs.

We’d like to meet you!

Schedule a free 15 minute conversation and we’ll spend a few minutes getting to know each other so we can learn if what you are seeking and what we provide are a good fit for each other. If it seems like a fit, we’ll talk about next steps. If we’re not, we’ll help you find the right group for your needs.