By Robert Powell

Published May 19, 2017 at www.marketwatch.com Read the entire article here: Honoring the man who forever changed the financial planning profession

Dick Wagner always asked, ‘So, what are you going to do about it?’

- “Richard B. Wagner, one of the genuine original thinkers of the financial planning profession, died (in March) from injuries suffered after a fall. In over 30 years, Wagner, George Kinder, Roy Diliberto and a small group of other advisers conceived the financial life planning movement and expanded the frontiers of an emerging profession. During that period, financial life planning was transformed from an esoteric aspect of what advisors did into the mainstream.”

So wrote Evan Simonoff, editor of Financial Advisor magazine, in the wake of Wagner’s death.

What’s not been written in the weeks since is what advisers can do to honor the legacy of the man who forever changed the financial planning profession; the man whose book Financial Planning 3.0 just might serve as the bible for all financial planners in years to come; and the man who created Finology, the study of the relationships between human beings and money, among other things.

So, we put that question to Wagner’s colleagues: Given Wagner’s contribution to the financial planning profession, what are some ways financial planners can honor his memory in their practices with their clients? Here’s what they had to say:

We are professional financial planners

Financial planners should first reflect on Wagner’s contribution to the financial planning profession. “Dick expanded the boundaries of our thinking as financial planners,” says Marty Kurtz, the CEO of The Planning Center. “He imagined the way our business should be. He made us think about the difference between the industry of financial services and the profession financial planning, saying things like ‘they are not us and we are not them.’”

Others share that point of view. “We — financial planners — should embrace who we are and what we do as a profession and live that,” says Elissa Buie, president and CEO of Yeske Buie. “Work to build and communicate our profession, she says.

What’s more, Jacob noted that his father was always asking questions about who financial planners are as a profession and to continue to define and identify what it means to not just be a professional but how to drive the profession to become the best it can be and serve in the greatest possible way. “To understand that, if financial planning does its job right, we have a population that knows the consequences of their financial decisions and has financial ‘common sense,’” says Jacob Wagner.

Manage people — not their money

Kurtz also said Wagner taught financial planners to not only think about the numbers, but to also consider the internal conflict, the confusion or the stimulation we (financial planners and their clients) may have in a money discussion and what that might mean.

“He told us we have a higher calling as a profession and he defined who we need to be over the next decade and beyond. Being that third party people can discuss money and life with,” says Kurtz.

Kurtz also noted that Wagner saw the changing tide of influence that money has in our world and the vision of how totally encompassing our relationship with money could be in the future.

Kurtz further noted that financial planners have changed from a business of “right answers” to a profession of helping people deal with the effects of uncertainty. “We need a safe place to talk about our lives and our money. This is the need the financial planner must fill.”

And this, Wagner believed, is the financial planner’s destiny. “It is the study of Finology that the planner must learn and then through experience, take their clients on the same journey,” says Kurtz.

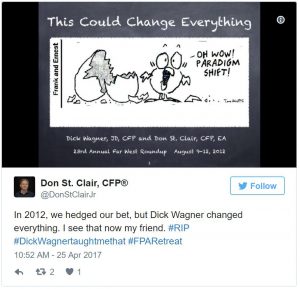

Another financial planner, who like many was a dear friend of Wagner, offered the following reflection and advice: “You don’t have to be in this business for more than 10 minutes to realize your role is going to be far more about managing people than it will ever be about managing their money,” says Don St. Clair, a principal at St. Clair Financial who tweeted other reflections under the hashtag, #DickWagnertaughtmethat. “Dick Wagner never let us forget that money was merely the common denominator, and that unlike politicians and economists, we were in the business of helping numerators. Those wanting to honor his legacy will never, ever, ever forget — money, is uniquely human.”

A young financial planner had a similar observation. “Dick cared deeply for people,” says Eric Roberge, a financial planner and founder of Beyond Your Hammock. “We are here to help people learn how to utilize money as a tool to live the life they envision for themselves. And, if they haven’t envisioned that life, we need to help create that vision with them.”

Advisers, says Jacob Wagner, should be asking their clients the deeper questions about mission and stewardship. “Helping people have effective financial planning is a great start,” he says. “Helping clients understand their relationship with money and create the life they want to have is the next step, but now we want folks to look at how we exchange value and become aware of the different types of reciprocity.”

That’s why it’s important to answer the question: “What is Finology? “Because,” says Jacob Wagner, “we need the planning community to work with academia to understand how we work with money and all the ways we exchange value. After we start to know what is in this garden of knowledge we can further define this territory that he named Finology.”

Continue to do financial life planning

From his perch, having launched the “life planning” movement with Wagner, George Kinder, founder and president of The Kinder Institute of Life Planning, had this to say: “The way to honor his legacy is simply to life plan your clients, and keep growing the movement.”

Others offered similar advice. “The financial life planning work we already do does honor and will continue to honor where Dick believes the profession needs to go,” says Lisa A.K. Kirchenbauer, president of Omega Wealth Management. “So, by continuing to do the work we do at Omega, we will honor Dick for many years to come.”

Be courageous

Planners can honor Wagner’s memory by having courage, says Lee Baker, the owner and president of Apex Financial Services. “We all must have the courage to engage in conversations that may make us feel vulnerable,” he said. “It is this vulnerability that may open the door to deeper conversations with our clients.”

Baker says advisers can honor Wagner’s memory by challenging the status quo. “Whether it comes in the form of shifting the focus from the numbers to focusing on the how the numbers support the life the client wants to live or if it comes in the form of championing diversity so that we can better create a world where everyone thrives and prospers we can all take a page from Dick’s book,” he says.

Ben Coombs, another legendary financial planner who is now retired, had similar words of advice. “Always question the status quo and step outside of the box from time to time,” he says.

Read Financial Planning 3.0 and practice finology

“Honestly, the first best thing a planner can do is really learn what Dick was — and will ever continue — teaching,” says Buie. She says it’s important to take a 360-degree look at clients and really getting what money means to us and how it impacts us.

For her part, Kirchenbauer says financial planners should all read Wagner’s book this summer. “I anticipate that alone will generate a bunch of conversation and contemplation.”

Others share that sentiment. “I’m actually reading his book now, and I think the key message that we all should take from it is that it is our job as practitioners to continue to push the industry forward, says Roberge. “We can do that by appreciating how far we’ve come, but never being satisfied with our current state.”

Donate

One more way financial planners can help carry on the legacy of Dick Wagner is by contributing to his memorial fund by emailing wagnerfund@onefpa.org. Jacob Wagner also noted that he’s working with the CFP Board and the Financial Planning Association on a way to memorialize his father’s legacy.

And finally, financial planners can honor Wagner’s legacy by duly noting this fact: Life planning is key, because it delivers freedom,” says Kinder. “Without Dick Wagner, there would be no life planning movement.”

Robert Powell is editor of Retirement Weekly, published by MarketWatch. Read the entire article again here: Honoring the man who forever changed the financial planning profession